Last updated on June 23rd, 2021 at 02:39 pm

India Pesticides Limited IPO

Incorporated in the year 1984, India Pesticides Limited is coming up with its IPO amounting to Rs 800 crore. The offer comprises of fresh issue of Rs 100 crore. The Issuer’s registered office is in Bareilly, Uttar Pradesh.

Offer details of India Pesticides Limited IPO

[su_table]

| Offer Details | |

| Offer Size | Rs 800 crore |

| of which | |

| Fresh Issue | Rs 100 crore |

| Offer for sale | Rs 700 crore |

| Price Band | Rs 290-296 per share |

| Offer Period | June 23 -June 25 2021 |

| Offer Structure | QIBs: upto 50% of the offer NIIs: upto 15% of the offer RIIs : upto 35% of the offer |

| Market Lot | Minimum 1 lot(50 shares), Rs 14800 Maximum 13 lots (650 shares), Rs 1,92,400 |

| Listing on | BSE, NSE |

| BRLM’s | Axis Capital, JM Financial |

| Registrar | Kfintech |

[/su_table]

Objects of the Offer/Utilisation of fresh issue proceeds

- Funding working capital requirements (Rs 80 crore)

- General Corporate purposes

India Pesticides Limited IPO Subscription Status

Business Review of India Pesticides

India Pesticides is an R&D-driven agrochemical manufacturer of Technicals with a growing Formulation business. The Company manufactured 15,003 MT of Technicals in FY21. India Pesticides is the sole Indian manufacturer of five Technicals and among the leading manufacturers globally for Captan, Folpet, and Thiocarbamate Herbicide, in terms of production capacity. The Issuer currently has two manufacturing facilities located at UPSIDC Industrial Area at Dewa Road, Lucknow and Sandila, Hardoi in Uttar Pradesh, India that are spread across over 25 acres.

Product portfolio

The Issuer has two distinct operating verticals:

Technicals: Manufacture generic Technicals that are used in the manufacture of fungicides and herbicides as well as APIs with applications in dermatological products. The revenues from the Technicals segment amounted to Rs 256 crore (75%), Rs 383 crore (80%), and Rs 507 crore (79%) respectively for FY19, FY20, and FY21.

Formulations: Manufacture and sell various formulations of insecticides, fungicides, and herbicides, growth regulators, and Acaricides, which are ready-to-use products. The revenues from the formulations segment amounted to Rs 84 crore (25%), Rs 95 crore (20%), and Rs 136 crore (21%) respectively for FY19, FY20, and FY21.

The Technicals product category is primarily exported and revenue generated from exports contributed to 56.71% of revenue from operations in FY21. Exports are made to over 25 countries including Australia and other countries in North and South America, Europe, Asia, and Africa. The formulations products are primarily sold domestically through the extensive network of dealers and distributors. The customer base includes crop protection product manufacturing companies, such as Syngenta Asia Pacific Pte. Ltd, UPL Limited, ASCENZA AGRO, S.A., Conquest Crop Protection Pty Ltd, Sharda Cropchem Limited, and Stotras Pty Ltd; associated with the Company for over 10 years.

Financial Review

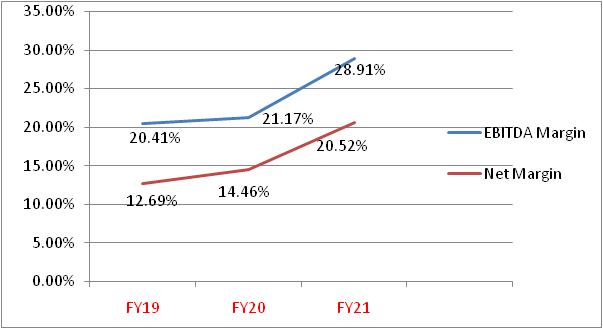

The financial performance of India Pesticides has shown an increasing trend over the last three fiscals. Revenues generated from operation increased by 41% to Rs 655.38 crore from Rs 489.73 crore. This was due to an increase in exports led by an increase in installed capacity. PAT earned was Rs 189.49 for FY21 crore as against Rs 103.66 crore for FY20. Profitability margins have remained strong throughout the last three fiscals as can be seen from the chart.

Cash generated from operations has been robust at Rs 83.28 crore for FY21. The Issuer has negligible debt.

Valuation and Peer Comparison

At NAV of Rs 34.94, P/BV is 8.47 at the upper price band of Rs 296 per share. With EPS of 12.07 per share for FY21, P/E is 24.52x calculated at the upper price band. The Peer group average P/E is 47.44x which indicates that the Issue is adequately priced.

As per RHP Dhanuka, Bharat Rasayan, UPL Ltd, Rallis, Sumitomo are shown as the peers of the Issuer.

Conclusion/Investment Strategy

The key growth driver in the agrochemical sector is the need for increased crop production to feed the increasing population. Hence there is an increased demand for agrochemical products. Also, the well-diversified product portfolio of the agrochemical companies mitigates the seasonal demand for the products.

India Pesticides has strong R&D capacities leading to the development of new molecules as per the market needs. The Issuer has developed a niche portfolio of agro-chemical products. The Issuer has strong profit margins and consistent financial performance. Looking at these factors, one may subscribe to the issue.

- One MobiKwik Systems Limited, MobiKwik IPO - 14/10/2021

- Bharti Airtel Rights Issue- Should You Subscribe? - 07/10/2021

- How to Check your IPO Allotment status? - 28/09/2021

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment