Last updated on May 9th, 2021 at 10:57 am

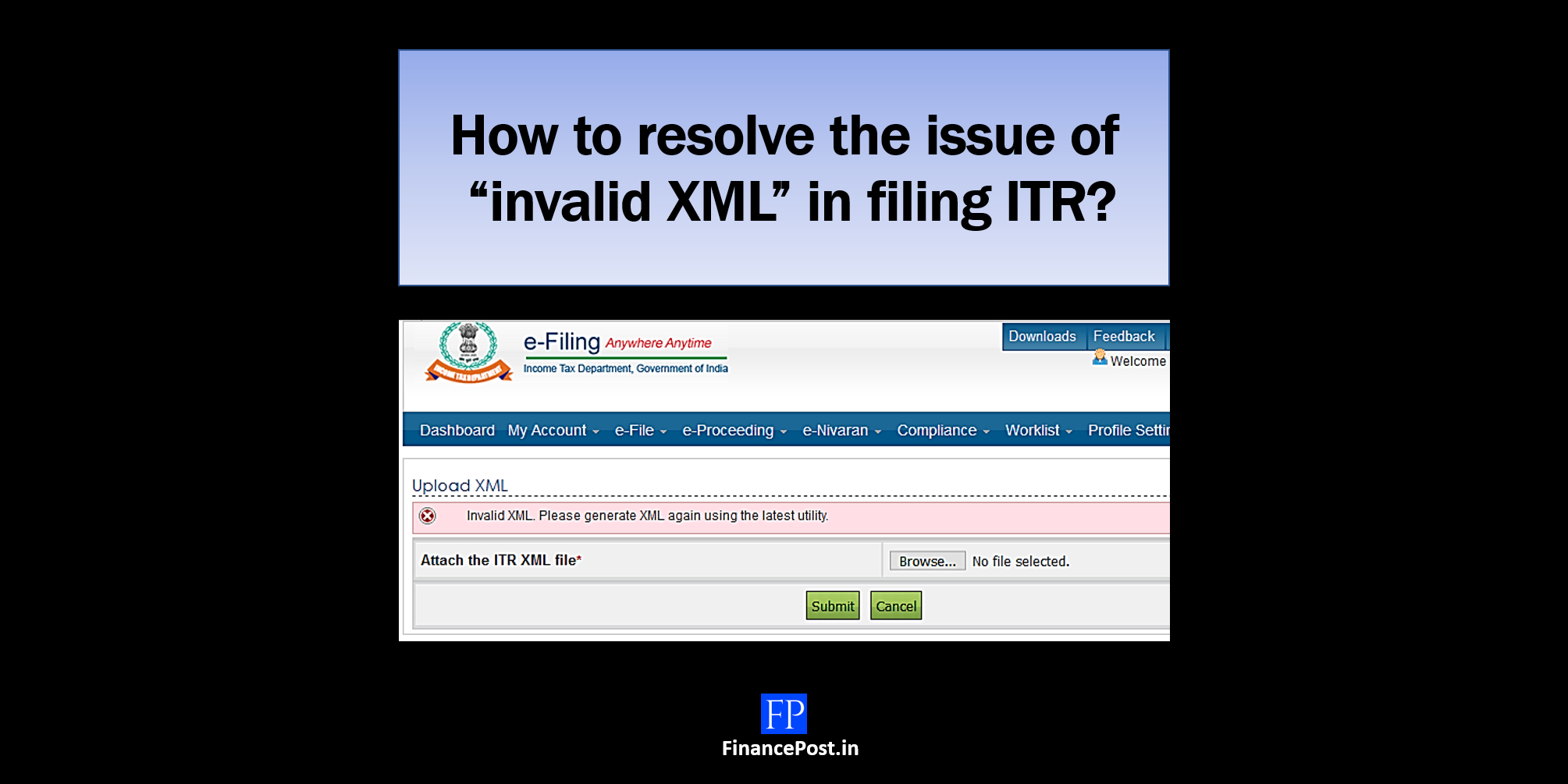

How to resolve the issue of “invalid XML” in filing ITR?

Some basic instructions to be followed while filing ITR

Make sure you select the correct assessment year for which the ITR is to be filed.

The downloaded ITR needs to be extracted from the zip file to fill in the details and use it for return filing.

One should always download the latest version of ITR from the e-filing portal.

System Requirements

- Excel Utility – Macro enabled MS-Office Excel version 2007/2010/2013 on Microsoft Windows 7 / 8 /10 with .Net Framework (3.5 & above)

- Java Utility – Microsoft Windows 7/8/10, Linux and Mac OS 10.x with JRE (Java Runtime Environment) Version 8 with latest updates.

What are the scenarios when the error message “invalid XML” pops up?/What to do if I get a message ‘invalid XML’ while trying to upload the XML?

Following are the three scenarios when the error message “Invalid XML” pops up

- If the taxpayer uses the older version of the ITR utility (Java/Excel) to fill up the details in return and tries to generate the XML file.

- If the taxpayer edits or alters the XML file before uploading the same to the Portal. (It will generate an error message “invalid XML”).

- If the taxpayer is using excel utility to prepare the ITR, an error message will come while generating XML. If the .Net 3.5 frameworks is not installed or not enabled.

What is the solution if the taxpayer has edited or altered the XML file before uploading the same to the Portal?

How to resolve the issue of “invalid XML” arising in Excel Utility?

Generally, the problem arises when the taxpayer tries to generate the XML file by using the older version of the ITR utility.

Steps to resolve the issue are

- Download the latest version of the ITR excel utility from the e-filing portal.

- Details can be imported in the newly downloaded ITR excel utility from the ITR which could not generate the XML file. For that, you have to click on the button ‘Import from Previous Version‘ which is available on the right-side panel.

- When you click on import from the previous version, it will browse your system and you have to select the saved excel file and click on the “open” button.

- Once you import, all the personal, as well as details that were filled and saved in the ITR utility(previous version), will be filled up in the newly downloaded Excel utility of ITR.

- One needs to thoroughly verify whether the details which are imported are correct or not.

- If there are any additional fields that need to be filled the same should be done before generating the XML.

- Later all the sheets should be validated and XML should be generated for uploading and filing the ITR on the e-Filing portal.

Note: – The feature of “import from the previous version” acts as a relief from the time-consuming process of entering the details in ITR again and in turn, result in the duplication of work.

How to resolve the issue of “invalid XML” arising in JAVA Utility?

- Download the latest version of ITR Java utility from the e-filing portal.

- Open the latest ITR Java utility and Click on the ‘Open’ button from the Menu bar.

- Select the XML file (previous version of the Java utility) from which the details need to be imported in the newly downloaded ITR Java utility.

- All the information from the imported version will be incorporated in the latest version of the ITR Java utility.

- One needs to thoroughly verify whether the details which are imported are correct or not.

- If there are any additional fields that need to be filled the same should be done before generating the XML.

- Later all the sheets should be validated and XML should be generated for uploading and filing the ITR on the e-Filing portal.

How to resolve the issue of “invalid XML” arising as .Net 3.5 frameworks is not installed or not enabled?

If a person uses a PC in which the .Net 3.5 frameworks might have not installed or not enabled to generate the XML file. It can be resolved by following the below procedure

If it is not installed

Then install the .Net 3.5 Framework from this link provided by the e-filing portal. And then enable it.

If it is not enabled

Then enable the .Net Framework by following the below procedure

- Go to Control Panel ⇒ Go to Programs ⇒ Go to Programs and Features ⇒ Turn Windows features on or off ⇒ Select the .NET Framework 3.5 (includes .NET 2.0 and 3.0) ⇒ Select OK.

Now restart the System and then generate the XML file afresh and upload it on the e-filing portal.

Related Posts

- 50th GST Council Meeting - 11/07/2023

- GST Compliance Calendar of October 2023 - 01/04/2023

- GST sections amended in Finance Act 2023 - 27/03/2023

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment