Last updated on July 7th, 2021 at 08:49 pm

Key Financial Highlights of Clean Science and Technology

- Robust Financial Performance: The company’s total revenue increased by 25% in FY21 to Rs 538.07 crore from Rs 430.17crore for FY20. PAT posted for FY21 was Rs 198 crore in FY21 as against Rs 139 crore in FY20.

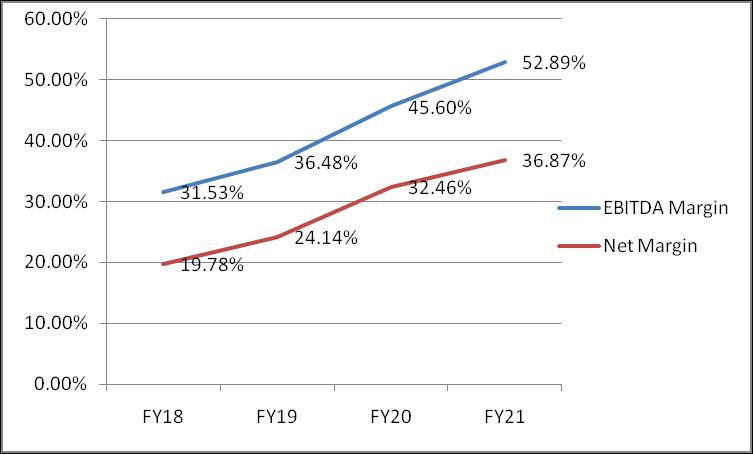

- The Issuer posted strong EBITDA and net margins as plotted in the chart.

- RoNW for FY21 is 37%. The Issuer has negligible debt on the books.

- With an EPS of 18.68 per share, the P/E is 48.18 times calculated at the upper price band of Rs 900 per share. The average sector P/E is 55.38x indicating the Issue to be fully priced.

- P/BV is 17.71x at an upper price band of Rs 900 per share.

Business analysis of Clean Science and Technology IPO

Chart showing margins

Valuation Parameters

[su_table]

| Valuation Parameters | EPS | P/E | NAV | P/BV |

| 18.68 | 48.18 | 50.81 | 17.71 |

[/su_table]

Peers Key Financial Metrics

| Peer Comparison | Total Income (FY21) | EPS | P/E | RoNW |

| Vinati Organics | 980.1 | 26.2 | 68.43 | 17.45% |

| Fine organics | 1150.3 | 39.25 | 75.93 | 16.45% |

| Atul | 3834.5 | 221.17 | 40.01 | 17.11% |

| Camlin Fine | 1192.1 | 4.13 | 47.65 | 9.16% |

| SRF Limited | 8454.5 | 205.54 | 34.37 | 17.47% |

| Navin Fluorine | 1258.4 | 52.03 | 64.43 | 15.76% |

| PI Industries | 4701.9 | 49.92 | 56.83 | 13.82% |

| Clean Science | 538.1 | 18.68 | 48.18 | 36.76% |

[/su_table]

Investment Strategy- Subscribe

Clean Science and Technology Company is a global company focused on manufacturing speciality chemicals. The company has a niche market segment. Issuer’s financial performance is robust with strong margins and low debt levels. Hence, one may subscribe to the IPO.

RHP of Clean Science and Technology IPO

- One MobiKwik Systems Limited, MobiKwik IPO - 14/10/2021

- Bharti Airtel Rights Issue- Should You Subscribe? - 07/10/2021

- How to Check your IPO Allotment status? - 28/09/2021

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment