Last updated on May 9th, 2021 at 01:49 pm

Income Tax Benefit u/s 80C

All the individuals and Hindu Undivided Family (HUFs) can avail income tax benefit for certain payments. These benefits are listed under sections 80C, 80CCC, 80CCD etc.

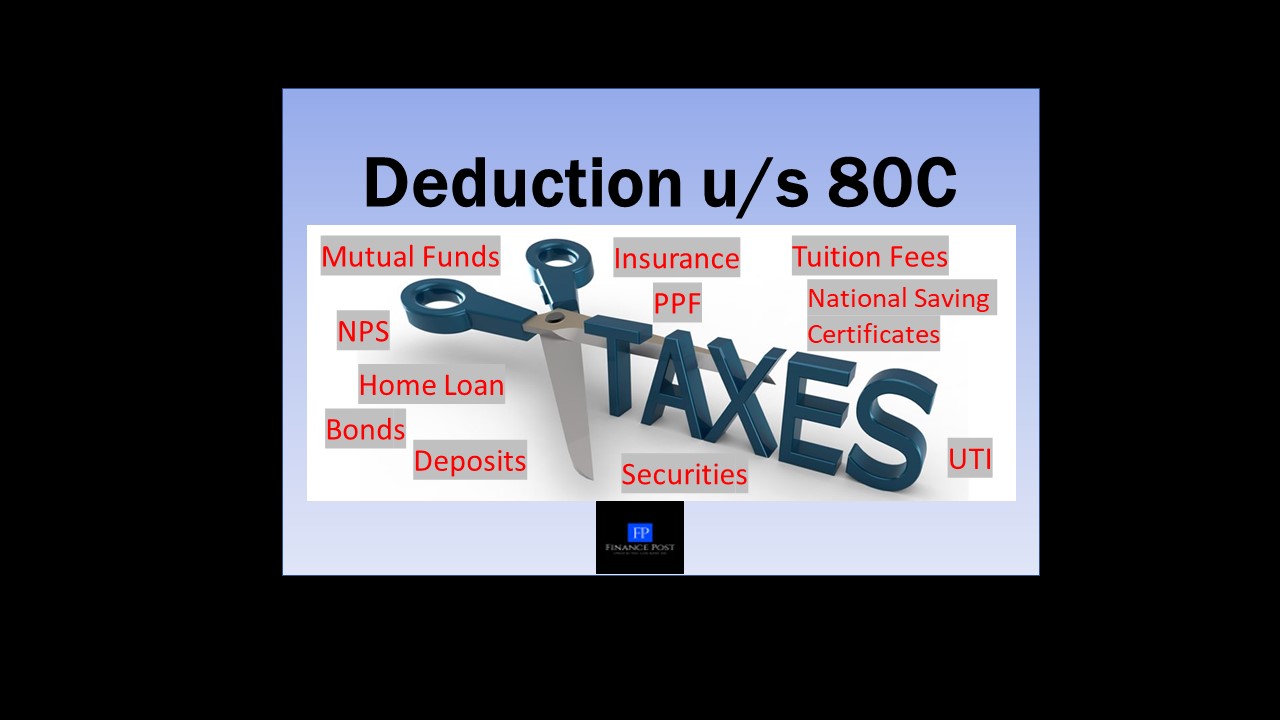

Section 80C

Section 80 C talks about deduction in the taxable income of an individual or HUF for certain payments done during the year towards life insurance premium, deferred annuity, contributions to provident fund, subscription to certain equity shares or debentures, etc. The maximum deduction available under this section is Rs 1.5 lakhs for FY 2018-19 and FY 2019-20. Please note that this deduction limit along with deductions under sections 80CCC and 80CCD is restricted to Rs 1.5 lakhs.

The payments covered under this section are listed below:

1. Life insurance premium:

An individual can claim the deduction for the life insurance premium paid for covering the life of himself / spouse or his children. In the case of HUF, a premium paid for the life of any member of the HUF can be availed as a deduction.

2. Deferred Annuity Plan:

An individual can claim the deduction for the amounts paid towards the Deferred Annuity Plan for himself / spouse or his children. In the case of HUF, the amounts paid for the life of any member of the HUF can be availed as a deduction.

However, the contract should not contain an option to receive a cash payment in lieu of the annuity, to avail this deduction.

3. Amounts deducted from the salary payable to Government servant towards securing deferred annuity or making provision for his/her spouse/children. The amount qualified for deduction is restricted to 20% of the salary.

4. Contributions towards the Employees’ Provident Fund Scheme (PF) done by individuals. The amounts contributed to “employee’s share” will be considered for deduction.

5. Contributions towards the Public Provident Fund Account (PPF):

Individuals or HUFs are allowed to contribute towards Public Provident Funds irrespective of whether they are salaried or self-employed. The deduction available in case of an individual is the contribution towards him/herself or his /her spouse or any child of such individual. In case of HUF, the amounts paid for in the name of any member of the HUF can be availed as a deduction.

- Contribution by an employee towards a recognized provident fund or an approved superannuation fund

7. Subscription towards any notified security or deposit scheme of the Central Government. For example, Sukanya Samriddhi Yojana.

8. Subscription towards National Savings Certificates (VIII Issue)

9. Contribution towards any unit-linked Insurance Plan of UTI.

An individual can claim the deduction for the life insurance premium paid for covering the life of himself / spouse or his children. In case of HUF, a premium paid for the life of any member of the HUF can be availed as a deduction.

10. Contribution towards notified unit-linked insurance plan of LIC Mutual Fund:

An individual can claim the deduction for the life insurance premium paid for covering the life of himself / spouse or his children. In case of HUF, a premium paid for the life of any member of the HUF can be availed as a deduction.

- Contribution towards notified annuity plan of LIC or other insurers

12. Tuition fees – Any tuition fees paid by an individual (other than development fees, donations, etc.) to any university, college, school or other educational institution situated in India, for full-time education of any 2 children of him/her can be claimed as a deduction under this section.

13. Certain payments for purchase/construction of residential house property, like principal repayment of Housing Loan, etc (Click here to know more details on the deduction of Home Loan under this section)

14. Subscription towards notified schemes of housing companies especially-

Public sector companies engaged in providing long-term finance for purchase/construction of houses in India for residential purposes OR

Authority constituted under any law for the satisfying need for housing accommodation or for planning, development or improvement of cities, towns or villages

15. Subscription to any units of any notified Mutual Fund u/s 10(23D)or the UTI (Equity Linked Saving Scheme, 2005)

16. Contribution to any pension fund set up by any mutual fund which is referred to in section 10(23D) or by the UTI (UTI Retirement Benefit Pension Fund)

17. Subscription to equity shares or debentures of a public company or public financial institutions

18. Subscription to any units of any approved mutual fund

19. Investment in fixed deposit for 5 years or more with a scheduled bank, and which is in accordance with a scheme framed and notified.

20. Subscription to NABARD bonds.

21. Deposit in an account under the Senior Citizen Savings Scheme Rules, 2004 (subject to certain conditions)

22. 5-year term deposit in an account under the Post Office Time Deposit Rules, 1981 (subject to certain conditions).

Related Posts

- How to do a transaction in Digital Rupee (CBDC-R)? – A Step by step Guide - 10/12/2022

- Can you rectify your 26AS? - 20/09/2022

- Tax implications on Cashback - 09/09/2022

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment