GST Clarifications on Debit Notes, Refunds, and Physical copy of invoices

(Circular No. 160/16/2021-GST dated 20th September 2021)

A claim of ITC in respect of debit notes

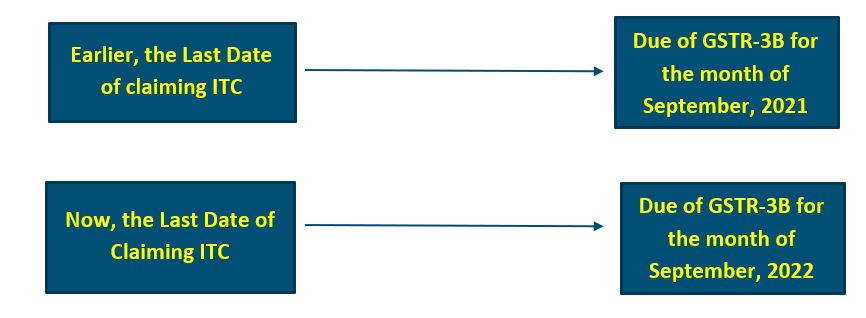

The date of issuance of debit notes is delinked from the date of issuance of the invoices w.e.f. 01.01.2021 as per the amended provision 16(4) amended vide Finance Act, 2020.

Now, after the delinking, the input tax credit on debit notes can now be claimed up to the return of the month of September is filed from the end of the Financial Year to which the invoice relating to such debit note pertains.

For example: –

Date of Debit Note: – 04.04.2021

Date of Invoice: – 30.01.2021

The last date of claiming ITC has changed w.e.f. 01.01.2021, earlier the last date was calculated from the date of invoice but now, the last date is calculated from the date of debit note.

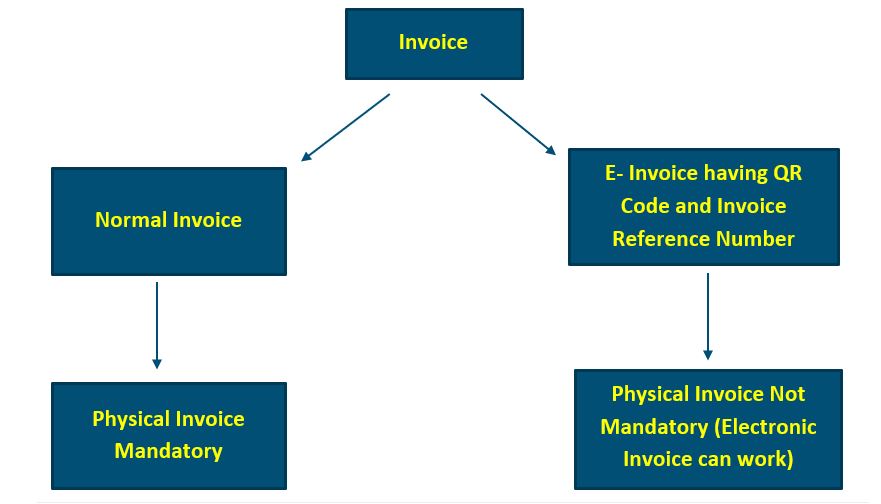

Is the physical copy of the invoice mandatory during the movement of goods?

As per CGST Rule 138A(1), the person-in-charge of the conveyance shall carry the following documents: –

- Invoice or Bill of Supply or Delivery Challan

- E-way bill or E-way bill number

As per CGST Rule 138A(2), in cases where e-invoicing is applicable, then the person in charge of the conveyance may carry an electronic copy of the invoice instead of the physical copy of the invoice.

After the combined reading, we can draw the following conclusion

Refund of Unutilized ITC can be claimed for Goods with NIL rate of Export Duty?

The second proviso to Section 54(3) states that the refund of Unutilized ITC shall not be allowed for Goods exported are subject to Export Duty.

There were many confusions regarding the NIL Rated Goods exported out of India, whether they will be covered under the Second proviso to Section 54(3) or not.

Accordingly, It has been clarified that where the duty is actually been paid at the time of export will be covered under the Second Proviso to Section 54(3) and no refund of Unutilized ITC shall be allowed.

Therefore, refund of Unutilized ITC shall be allowed on NIL-rated Goods exported out of India.

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Sir Aapke Articles Tax Gyaan ko badhane or sikhne ke liye bahoot upyogi hote hain. Aapka Haardik Aabhar.👏👏👏🙏🙏🙏

Thank you for the appreciation