A Quick Update on SBI CARD IPO

Last updated on May 9th, 2021 at 10:58 amA quick update on SBI CARD IPO which opens on 2nd March 2020 Subscription for SBI CARD IPO opens tomorrow (March 2nd to March 5th) The subscription lasts for […]

Last updated on May 9th, 2021 at 10:58 amA quick update on SBI CARD IPO which opens on 2nd March 2020 Subscription for SBI CARD IPO opens tomorrow (March 2nd to March 5th) The subscription lasts for […]

Last updated on April 9th, 2021 at 08:11 pmMost Awaited: SBI CARDS IPO Click here to know >>> SBI Cards IPO listing – HIGH hopes but low on DEBUT?? Click here to know >>> Fundamental analysis & […]

Last updated on August 2nd, 2021 at 05:11 pmStandard Deduction for salaried Individuals It is a deduction allowed to salaried individuals. It is mainly a flat amount that is subtracted from the salary income before […]

Last updated on June 9th, 2021 at 09:40 pmIncome Tax Slab Rates – FY 20-21 (AY 21-22) Taxpayers were given an option to choose between the existing/old tax regime or a new/alternate tax regime in […]

Last updated on July 19th, 2022 at 08:57 amBudget 2020: Highlights Budget Highlights: What is changing? On 1st Feb 2020, the Finance Minister Ms. Nirmala Sitharaman presented the Union Budget. These budget announcements will be […]

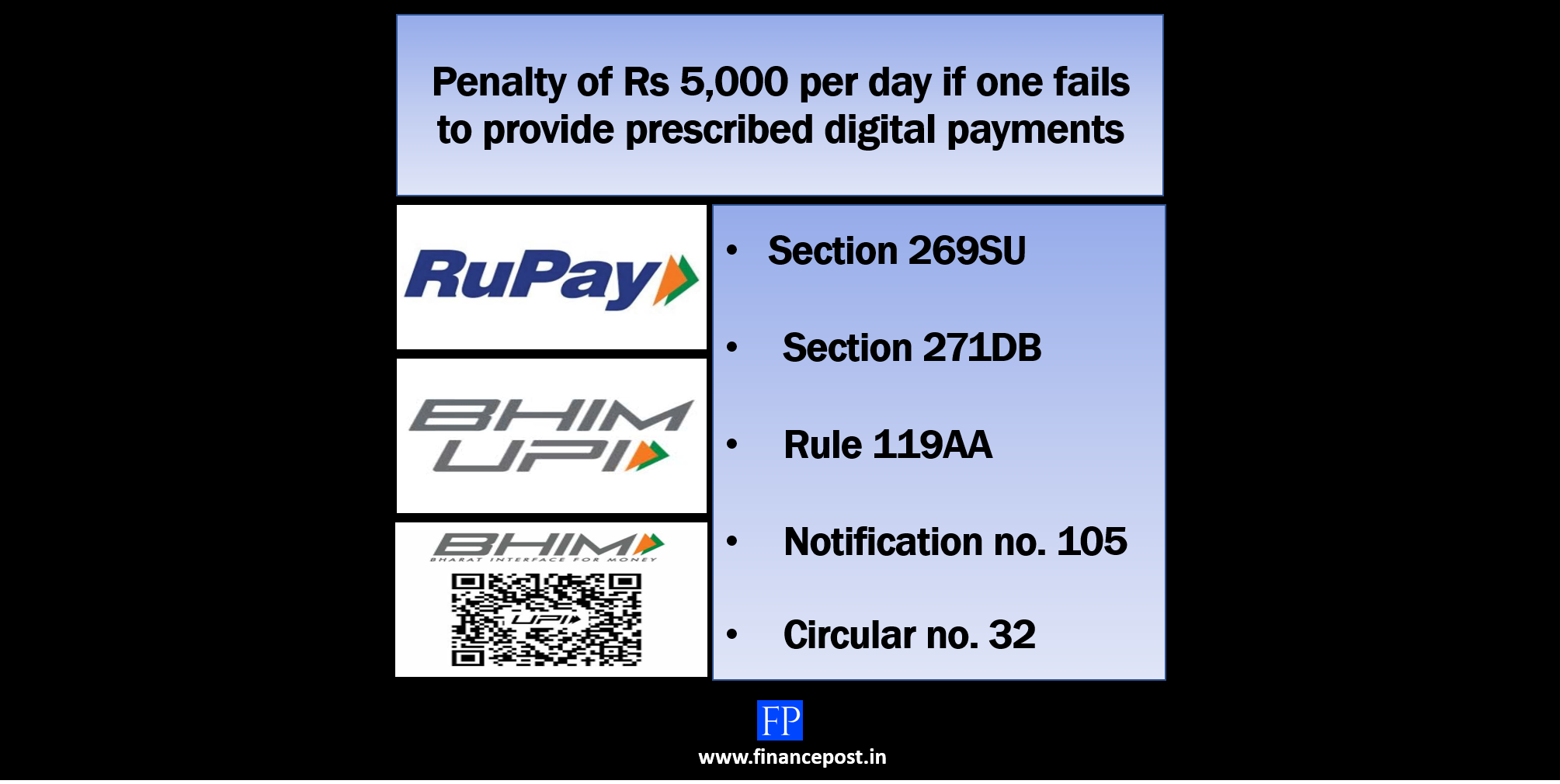

Last updated on April 2nd, 2022 at 01:17 pmPenalty of Rs 5000 per day for non-compliance with section 269SU by 31st January 2020 Businesses having a turnover of more than Rs. 50 cr. in the […]

Last updated on May 9th, 2021 at 11:10 pmBudget 2020 Expectations : “Populist” or “Mixed Bag” ? The Financial Year 2019-20 saw many Budget announcements by the FM. Starting with Interim Budget in February 2019, […]

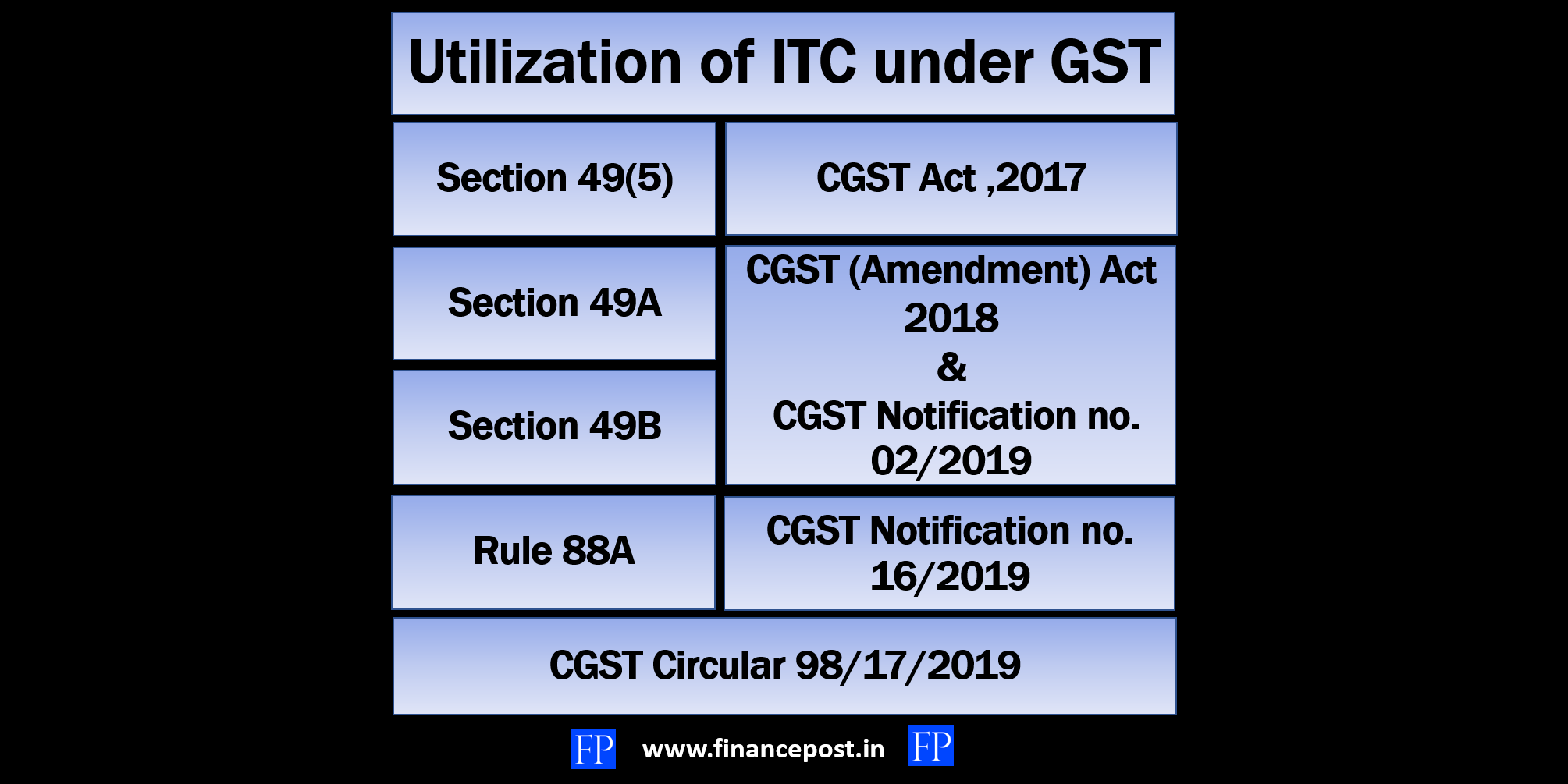

Last updated on March 31st, 2021 at 03:07 pmUtilization of ITC under GST Overview As per the CGST Act, 2017 – The order of utilization of ITC was as per section 49(5). As per CGST […]

Last updated on March 24th, 2021 at 10:38 amCan you file a delayed tax return after 31st December? Generally, individuals and HUFs without tax-audit requirements, are required to file their income tax returns by 31st […]

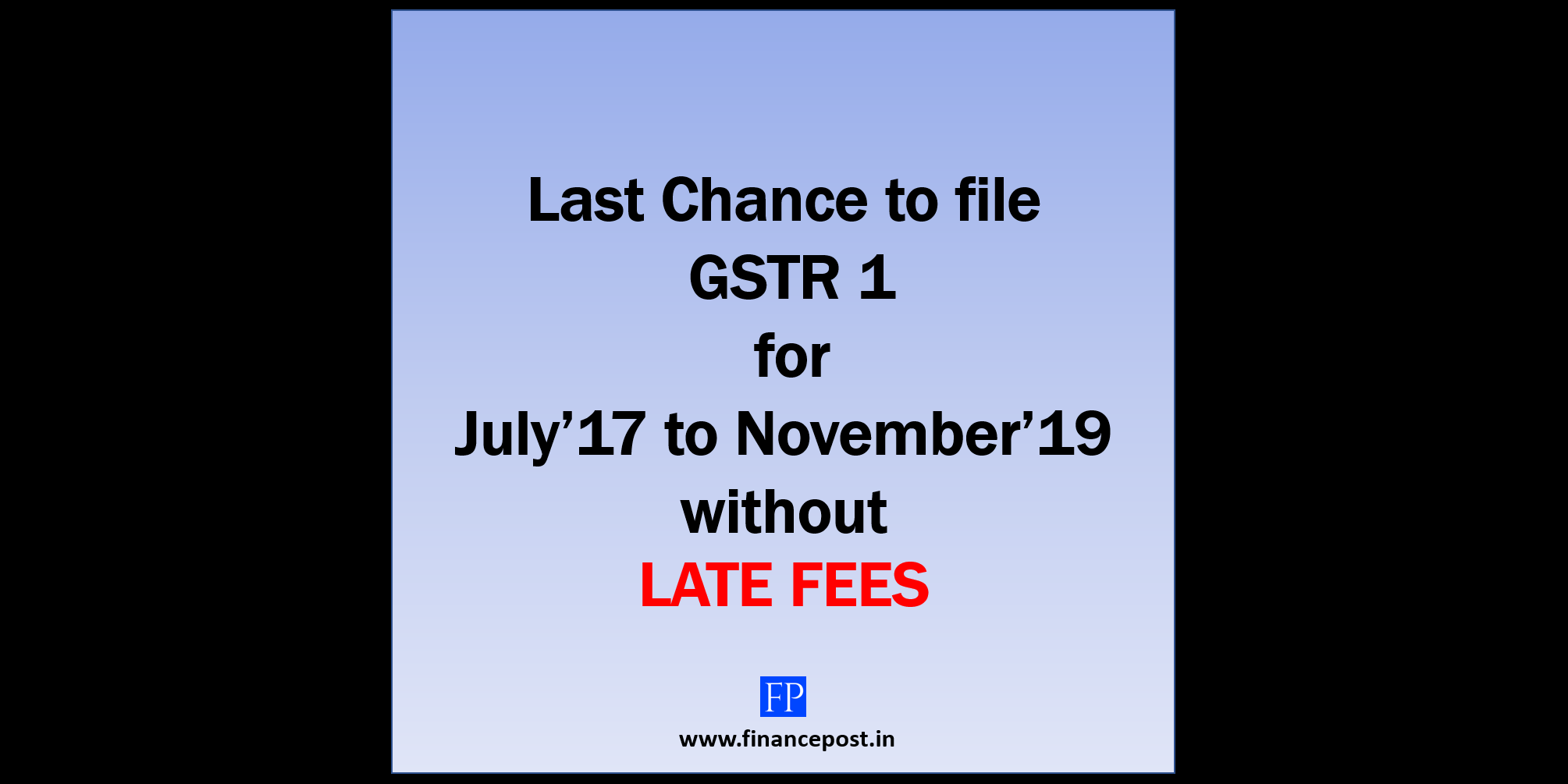

Last updated on July 26th, 2021 at 06:41 pmLast chance to file GSTR 1 without late fees Due date to file GSTR-1 without late fees extended to 17th January 2020 The government claims that the […]

Copyright © 2025 | MH Magazine WordPress Theme by MH Themes