GST

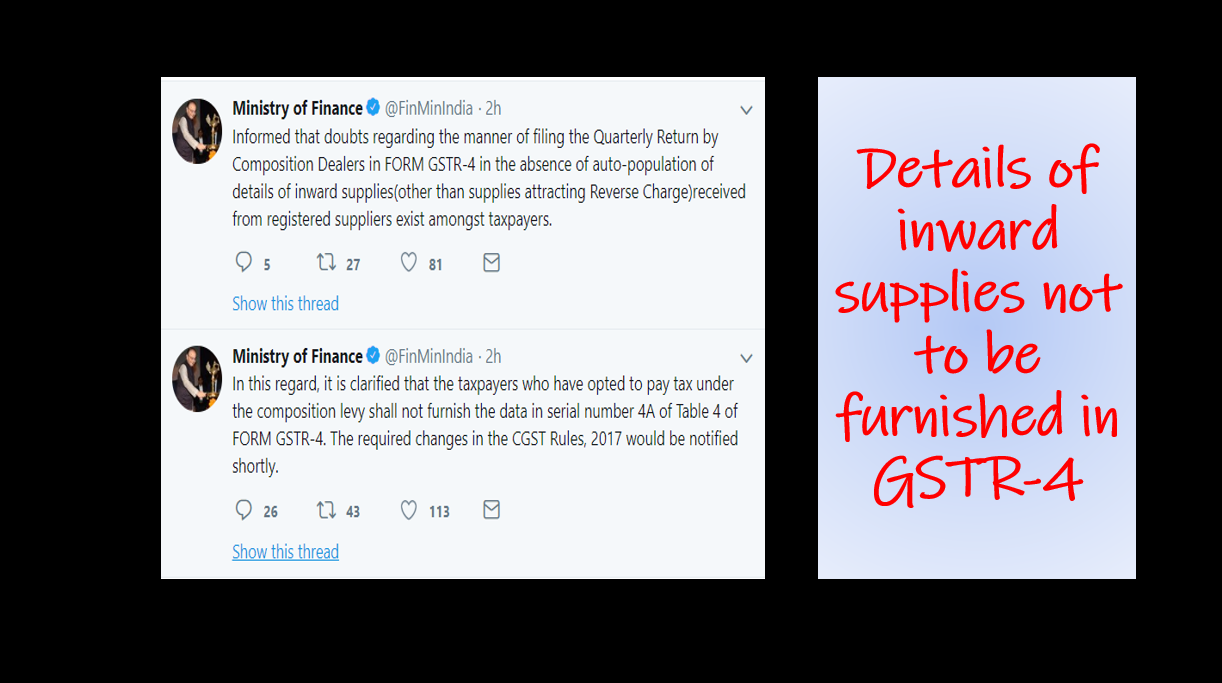

Details of inward supplies not to be furnished in GSTR-4

Last updated on September 17th, 2022 at 04:14 pmDetails of inward supplies not to be furnished in GSTR-4 Note: The exemption details discussed in this article were provided by CBIC for GSTR 4(quarterly return) which […]