Last updated on May 8th, 2021 at 10:58 pm

Procedure to opt for composition levy by a service provider

The decision to bring service providers under the composition scheme was taken in 32nd GST Council Meeting held on 10th January 2019.

Brief about the composition scheme as per notification No. 2/2019-Central Tax (Rate) dated 07.03.2019

- Eligibility: A registered person providing goods or services or both up to an annual aggregate turnover of Rs. 50 lakhs in the previous year.

- Tax Rate: 6% (3% CGST+3% SGST)

- Input Tax Credit: No ITC can be claimed.

- Outward Supplies: Intrastate sale only allowed not interstate sales.

- Inward Supplies: Interstate purchases are allowed.

- Invoice: Only Bill of Supply has to be issued, not a tax invoice.

- Return: Annually in FORM GSTR-4

- Payment: Quarterly in FORM GST CMP 08

What is the procedure for a person who wants to register(new) for the composition scheme as per CGST(Rate) Notification no. 2/2019 dated 07.03.19?

A person who wants to register afresh for the above composition scheme of GST then one has to file an application for registration in FORM GST REG-01 and make sure that the options

- At serial no. 5 i.e. Option for composition – Yes is selected/ticked. and

- At Serial no. 6.1 i.e. Category of registered person – Option (iii)-“Any other supplier eligible for composition levy” is selected/ticked.

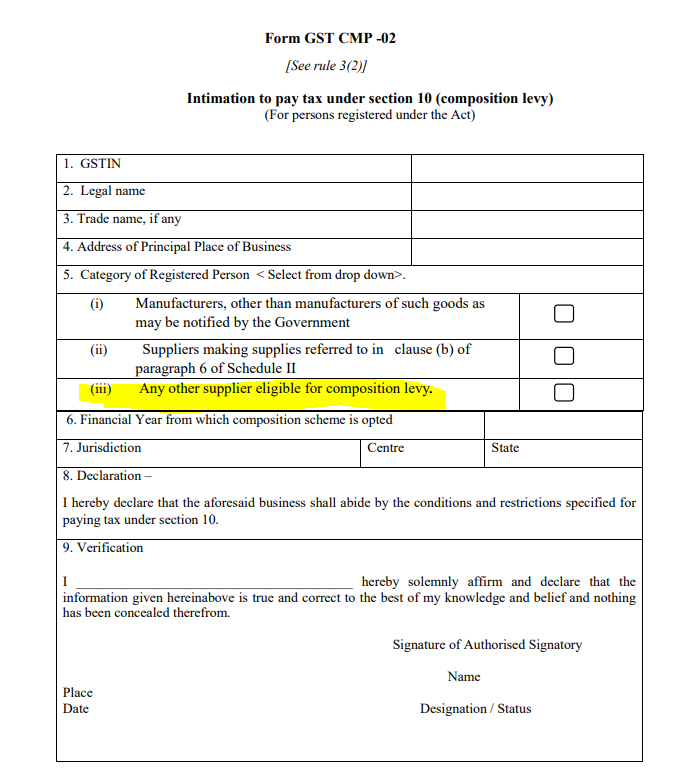

What is the procedure for a registered person who wants to change from a regular scheme to a composition scheme as per CGST(Rate) Notification no. 2/2019 dated 07.03.19?

A person who wants to shift from regular scheme to the above composition scheme of GST then one has to follow the below-mentioned procedure

File an intimation for change in registration in FORM GST CMP-02 and make sure that the option

- At Serial no. 5 i.e. Category of registered person – Option (iii)-“Any other supplier eligible for composition levy” is selected/ticked.

Option to opt for the scheme and file an intimation in FORM CMP 02 is now made available on the GSTN portal.

- File a statement of declaration in FORM GST ITC 03 of ITC reversal/payment of tax on inputs held in stock, inputs held in semi-finished goods, finished goods held in stock, and capital goods u/s 18(4).

Following notifications, circulars and GST forms are referred to compile the article. You may click on the links below to download.

- CGST Circular no. 97/2019 dated 5th April 2019 which clarifies how to exercise the option to pay tax @ 6% as per CGST(R) Notification No. 2/2019.

- CGST(Rate) Notification no. 2/2019 dated 7th March 2019 which provides the composition scheme for service providers.

- CGST(Rate) Notification no. 9/2019 dated 29th March 2019 which amends the above notification and provides for composition rules for service providers.

- Download FORM GST REG 01

- Download FORM GST CMP 02

- Download FORM GST ITC 03

Related Posts

- 50th GST Council Meeting - 11/07/2023

- GST Compliance Calendar of October 2023 - 01/04/2023

- GST sections amended in Finance Act 2023 - 27/03/2023

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment