Last updated on September 23rd, 2021 at 06:16 pm

Paras Defence and Space IPO Subscription Status

| Subscription Status {no. of times (x)} | ||||

| Particulars | Shares Offered | 21st Sep | 22nd Sep | 23rd Sep |

| QIB | 20,17,941 | 0.01 | 1.67 | 169.65 |

| NII | 15,36,856 | 3.77 | 26.32 | 927.70 |

| Retail | 35,85,996 | 31.36 | 68.57 | 112.81 |

| Total | 71,40,793 | 16.57 | 40.57 | 304.26 |

Key Financial Highlights

- The financial performance of the company is volatile as can be seen from the declining topline and bottom-line. During FY21, the total revenues of the Issuer reduced by 3% to Rs 144 crore from Rs 149 crore in FY20. The total revenues reduced by 8% in FY21 when compared to revenues of Rs 157 crore in FY19.

- The Issuer posted PAT of Rs 15 crore, (FY21) Rs19crore (FY20) and Rs 18 crore(FY19).

- The financial profile of the company was affected due to the pandemic. Disruption in the supply chain of raw materials during the pandemic resulted in lower revenue from operations.

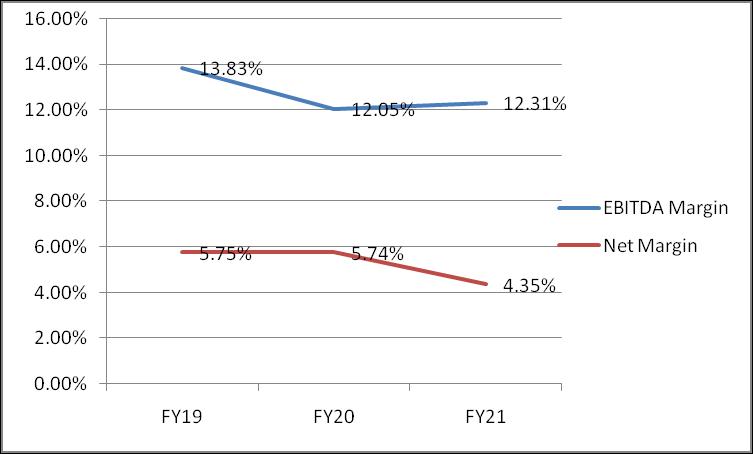

- The profitability margins can be seen from the chart below. They have remained quite stable over the last three fiscals.

- The Issuer has negative cash from operations for FY19 (Rs12.05) crore and FY18 (Rs 2.6 crore) and for FY21 it was Rs 4.29 crore. The sector in which Paras defence operates has higher working capital requirements.

- The Issue is priced at 31.53x with earnings of 5.55 as on 31st Mar 2021 and calculated at an upper band price of Rs 175 per share.

- P/BV is 3.17x at NAV of Rs 55.23 as on 31st Mar 2021.

- Paras defence does not have any listed peers as per the RHP. Data Patterns, Mistral Solutions, CoreEL technologies are some of the unlisted companies engaged in the production of certain products that Paras Defence also sells. Apollo Microsystems is also a similar company; its IPO was launched in the year 2018.

Paras Defence and Space Technologies IPO- Know all about it

Valuation Parameters

[su_table]

| Valuation Parameters | EPS | P/E | NAV | P/BV |

| 5.55 | 31.53 | 55.23 | 3.17 |

[/su_table]

Profitability Margins chart

Investment Strategy and Outlook

Under the ‘Atmanirbhar Bharat’ campaign of the Government of India, the Ministry of Defence (MoD) has prepared a list of 209 items, Positive Indigenization List. This would offer a great opportunity to the Indian defence industry to manufacture these items. The MoD has also Introduced Green Channel Status Policy (GCS) to promote and encourage private sector investments in defence production to promote the role of the private sector in defence production. Hence the sector has a positive outlook and seems to grow in the long term.

The Issuer has diversified into space optics; it undertakes in-house manufacture of drone cameras and space cameras in-house. The drones are in high demand and this would increase the revenues of the Issuer in the future and as well reducing its dependence on government orders. The PLI (Production-Linked Incentive) scheme of the government and new norms on drone technology are the positives for the company.

Though a volatile trend can be seen in the financials of the company its outlook appears strong in the long term with the Government’s supportive policies towards the private players. Hence, one may subscribe to the Issue.

The GMP of Paras Defence IPO was Rs 200 per share (100-115% premium over issue price)as on Sept 17, 2021. However one should not consider investment based only on strong GMPs as market correction is expected.

[su_table]

| Particulars (Fig in INR crore) | FY21 | FY20 | FY19 |

| Total revenue | 144.61 | 149.05 | 157.17 |

| PAT | 15.79 | 19.66 | 18.97 |

| Total Assets | 362.76 | 342.39 | 329.75 |

| RoNW | 7.64% | 11.39% | 12.45% |

[/su_table]

- One MobiKwik Systems Limited, MobiKwik IPO - 14/10/2021

- Bharti Airtel Rights Issue- Should You Subscribe? - 07/10/2021

- How to Check your IPO Allotment status? - 28/09/2021

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment