Last updated on September 14th, 2022 at 12:10 pm

E way bill for GOLD

Until now, there was no requirement to generate an e-way bill for transportation of gold whether it was inter-state or intra-state irrespective of the value of goods. In the 47th GST Council Meeting, it was left to states to decide whether they wanted to make e -way bills mandatory for intra-state movement of gold. Based on the above decision, a provision has been made on the e-way bill portal for the generation of e-way bills for the transportation of gold.

National Informatics Centre issued an update about the nuances of the e-way bill for gold on 12th September 2022

IT HAS NOT BEEN NOTIFIED BY ANY STATE GOVERNMENT YET (as on 14.09.2022)

When e-way bill will be mandatory for gold?

- If the state has notified the requirement for the generation of an e-way bill in which taxpayer is registered. The taxpayer should check the notifications, and exemptions issued by their respective state in this regard.

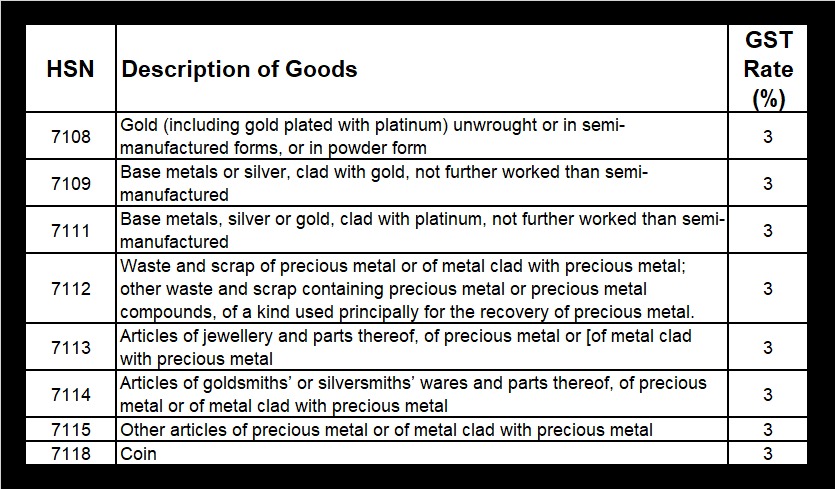

- E-Waybill for Gold will be mandatory when all the items belong to HSN Chapter 71 only.

Note: If other items which do not belong to HSN Chapter 71 exist along with HSN Chapter 71 then it will be treated like a normal e-way bill and details of Part-B shall be required.

List of GOLD items covered under Chapter 71

Part-A of E-way Bill for gold

It will have all the required details similar to any other e-way bill

- GSTIN of supplier

- GSTIN of recipient

- Address of supplier

- Address of recipient

- Invoice number

- Invoice date

- Value of goods

- HSN Code

Cancellations and rejection of e way bill of gold will be similar to e way bill of goods consignment.

The validity of the e-way bill will be calculated based on the pin-to-pin distance of origin and destination and have the same parameters as that of a normal e-way bill

Part-B of E-way Bill for gold

- Due to safety concerns, the generation of an e-way bill for gold will not require updating of part B i.e. details of vehicle number and details of transporter shall not be provided.

- Extension of e-way bill is permitted but without updation of Part-B details (Responsibility of extension of e-way bill will be with the consignor/consignee and not the transporter).

- Consolidated e-way bills cannot be generated.

- The multi-vehicle facility will not be available for the e-way bill of gold.

Conclusion

Certainly, the Government has tried to address the safety considering the value of goods and the risk of theft, robbery, and loot by not updating the details of part B of e way bill. How only generation of part A of the e-way bill will benefit the Government or people in the business of Gold will be known in times to come.

Only Part A of e way bill is almost the same as the e-invoice except it will not have IRN or QR code.

Related Posts

- 50th GST Council Meeting - 11/07/2023

- GST Compliance Calendar of October 2023 - 01/04/2023

- GST sections amended in Finance Act 2023 - 27/03/2023

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Most latest information shared. Thanks.

Thank you. Gald you found the information useful and relevant.

It is the most beneficial and latest information that has been shared. Thanks and regards.

Thank you for your appreciation. It motivates us to write more.