What is CESS Non Advol?

Last updated on May 9th, 2021 at 12:17 pmWhat is CESS Non-Advol? CESS Non-Advol Amount & Other Charges ⊗ For most of us, “CESS Non-Advol” was/is still a new term introduced by e way bill […]

Last updated on May 9th, 2021 at 12:17 pmWhat is CESS Non-Advol? CESS Non-Advol Amount & Other Charges ⊗ For most of us, “CESS Non-Advol” was/is still a new term introduced by e way bill […]

Last updated on January 18th, 2023 at 08:54 pmGST : Advance Ruling Overview An advance ruling is a written decision/interpretation of the law (called advance ruling) given by the Authorities of Advance Ruling to an […]

Last updated on April 14th, 2021 at 05:31 pmHow expired medicine will be treated under GST? In the pharmaceutical sector, the goods (drugs or medicines) have a defined term of life that is mandatory to […]

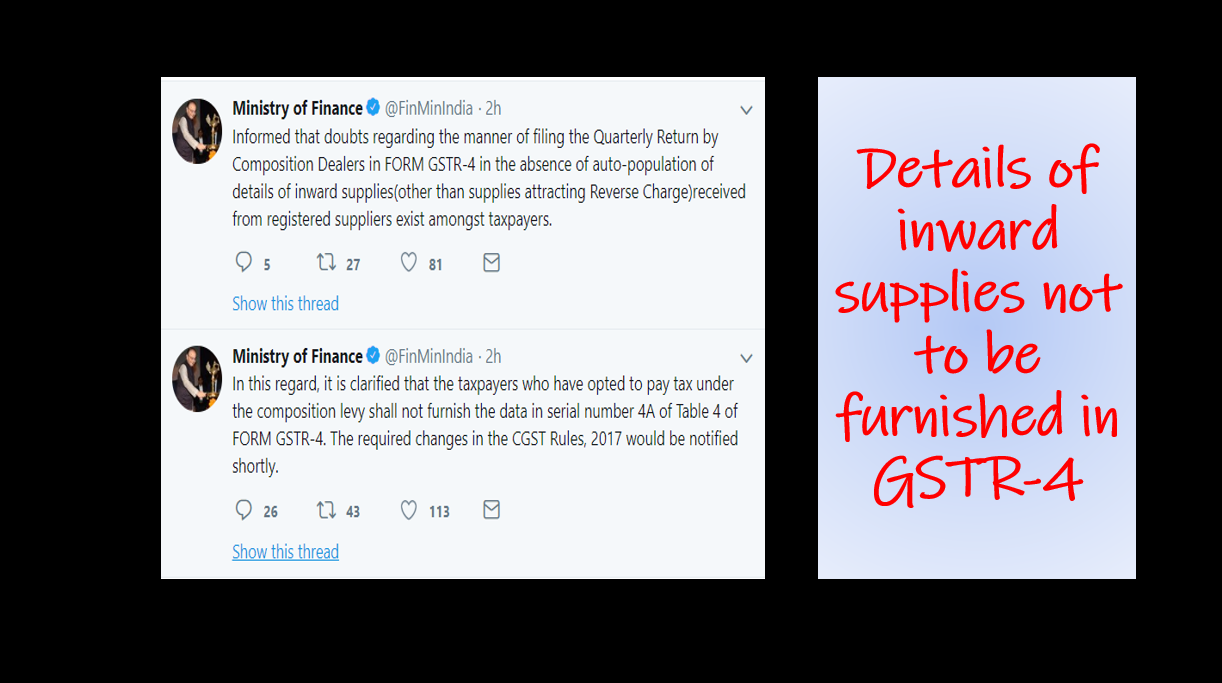

Last updated on September 17th, 2022 at 04:14 pmDetails of inward supplies not to be furnished in GSTR-4 Note: The exemption details discussed in this article were provided by CBIC for GSTR 4(quarterly return) which […]

Last updated on March 22nd, 2021 at 08:15 pmSome important clarifications on TDS under GST TDS under the GST mechanism has been made mandatory from 1st October 2018. Registration as a TDS deductor ⇒ Deductor […]

Last updated on April 14th, 2021 at 05:30 pmTDS under GST TDS under the GST mechanism has been made mandatory from 1st October 2018. What is TDS under the GST mechanism? The concept of TDS […]

Last updated on March 23rd, 2021 at 05:00 pmChanges in E-way bill applicable from 1st October 2018 Overview E- waybill is an electronic waybill that is required for the movement of goods valuing more than […]

Last updated on March 2nd, 2021 at 12:26 pmAnnual Return of GST An annual return is to be furnished once a year by all the registered taxpayers under GST. It is a consolidated return requiring […]

Copyright © 2025 | MH Magazine WordPress Theme by MH Themes