Last updated on March 31st, 2021 at 03:07 pm

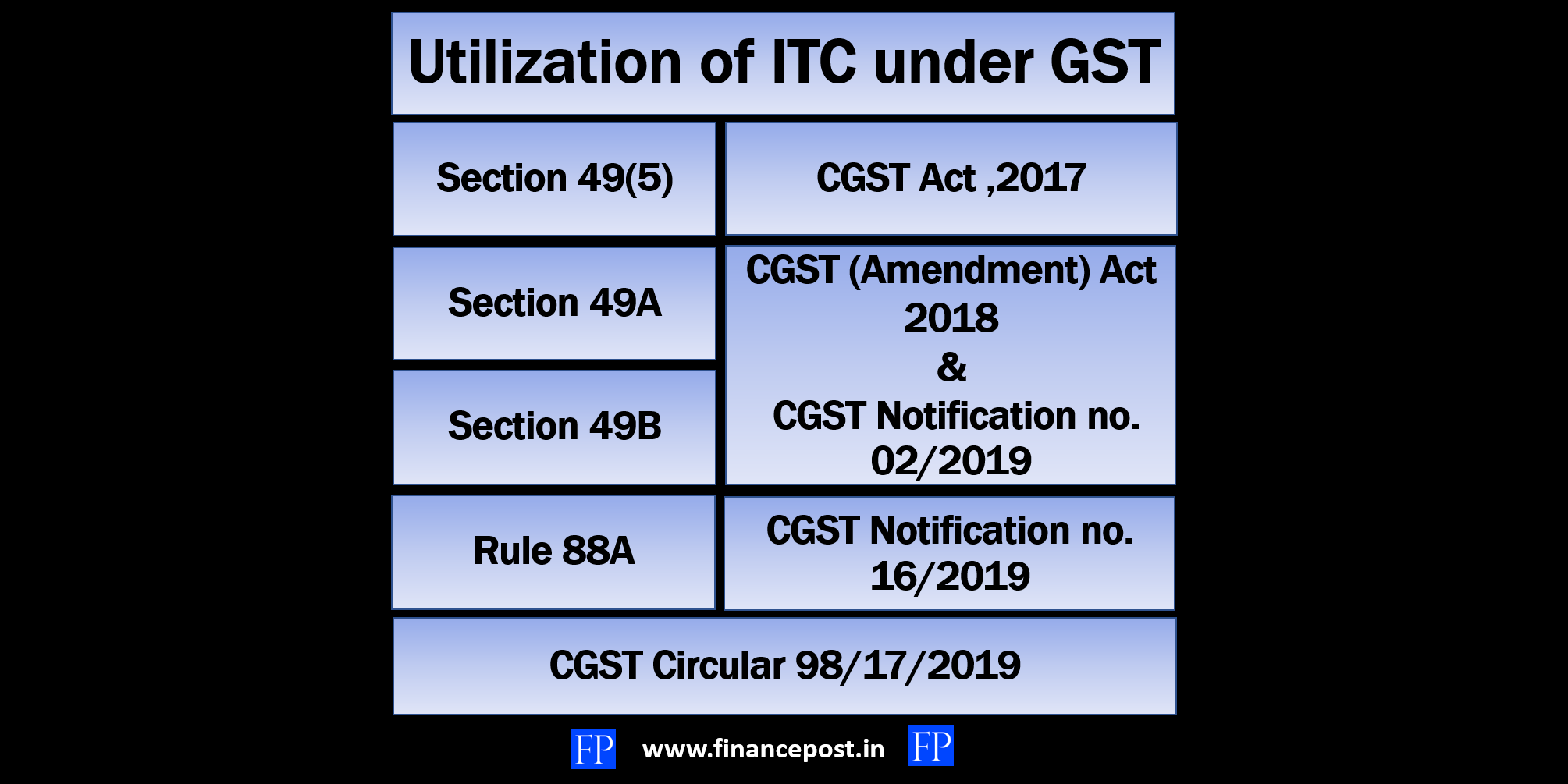

Utilization of ITC under GST

Overview

As per the CGST Act, 2017 – The order of utilization of ITC was as per section 49(5).

As per CGST (Amendment) Act, 2018 – The order of utilization of ITC under GST shall be as per the newly inserted section 49A & section 49B.

Changes notified for the utilization of ITC under GST

⇒ CGST (Amendment) Act, 2018 – Section 49 was amended to insert section 49A and section 49B. The CGST (Amendment) Act,2018 was passed by the Official Gazette of India on 29th August 2018.

⇒ CGST notification no. 02/2019 dated 29th January 2019 – Effective Date i.e. 1st February 2019 for the applicability of provisions of section 49A and section 49B was notified.

⇒ CGST Circular no. 98/17/2019 dated 23rd April 2019 – A clarification was issued in respect of the order of utilization of input tax credit under GST.

⇒ CGST Notification No. 16/2019 dated 29th March 2019 – Rule 88A was inserted to of CGST Rules, 2017 vide Second Amendment (2019) to CGST Rules to exercise of the powers under section 49B of the CGST Act.

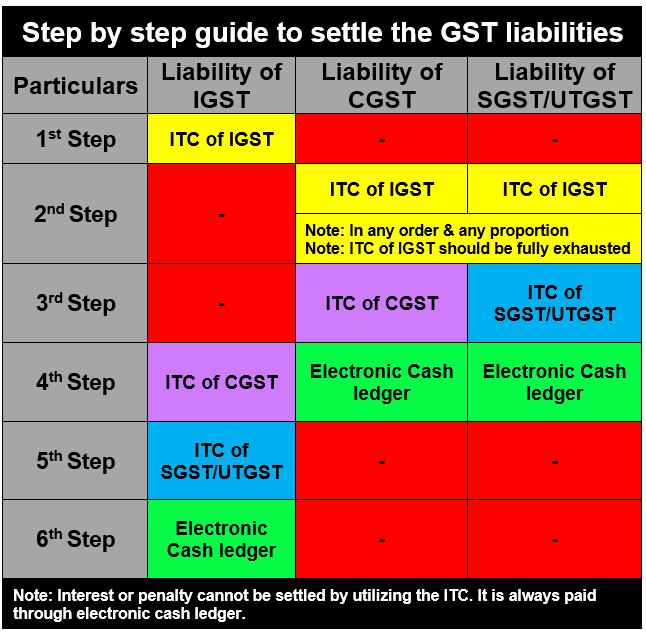

Tabular Format for utilization of input tax credit to settle the GST liabilities/ Utilization of ITC under GST

Let’s understand the rules for the utilization of different ITC

What will be the order for the utilization of ITC of IGST? | How to utilize the credit of Integrated Tax i.e ITC of IGST?

⇒ ITC of IGST will be first utilized to settle the liability of IGST.

⇒ Then ITC of IGST will be utilized to settle any liability such as CGST or SGST/UTGST in ANY ORDER or in ANY PROPORTION.

Note: ITC of IGST needs to be completely utilized for discharging the tax liability of IGST, CGST, SGST, UTGST. Only after the ITC of IGST is exhausted then other ITCs (i.e. ITC of CGST/SGST/UTGST) can be utilized to settle the dues.

What will be the order for the utilization of ITC of CGST? | How to utilize the credit of Central Tax i.e ITC of CGST?

⇒ ITC of CGST will be first utilized to settle the liability of CGST.

⇒ Then ITC of CGST will be utilized to settle the liability of IGST.

Note: ITC of CGST cannot be utilized to settle the liability of SGST/UTGST.

What will be the order for the utilization of ITC of SGST? | How to utilize the credit of State Tax i.e ITC of SGST?

⇒ ITC of SGST will be first utilized to settle the liability of SGST.

⇒ Then ITC of SGST will be utilized to settle the liability of IGST.

Note: ITC of SGST cannot be utilized to settle the liability of CGST/UTGST.

What will be the order for the utilization of ITC of UTGST? | How to utilize the credit of Union Territory Tax i.e ITC of UTGST?

⇒ ITC of UTGST will be first utilized to settle the liability of UTGST.

⇒ Then ITC of UTGST will be utilized to settle the liability of IGST.

Note: ITC of UTGST cannot be utilized to settle the liability of CGST/STGST.

Let’s understand the rules for settling the liabilities

How a liability of Integrated Tax i.e IGST be settled?

⇒ 1st > The liability of IGST shall be first settled by ITC of IGST. (ITC of IGST shall be first utilized to settle the liability of IGST.)

⇒ 2nd> Then the liability of IGST shall be settled by ITC of CGST (only if there is surplus ITC after settling the liability of CGST. )

⇒ 3rd > Then the liability of IGST shall be settled by ITC of SGST (only if there is surplus ITC after settling the liability of SGST. )

OR

⇒ 3rd> Then the liability of IGST shall be settled by ITC of UTGST (only if there is surplus ITC after settling the liability of UTGST. )

⇒ 4th> Then the liability of IGST shall be settled by electronic cash ledger.

How a liability of Central Tax i.e CGST be settled?

⇒ 1st > The liability of CGST shall be first settled by ITC of IGST. (only if there is surplus ITC after settling the liability of IGST. )

⇒ 2nd> Then the liability of CGST shall be settled by ITC of CGST. (ITC of CGST shall be first utilized to settle the liability of CGST.)

⇒ 3rd> Then the liability of CGST shall be settled by electronic cash ledger.

Note: The liability of CGST cannot be settled by ITC of SGST/UTGST.

How a liability of State Tax i.e SGST be settled?

⇒ 1st > The liability of SGST shall be first settled by ITC of IGST. (only if there is surplus ITC after settling the liability of IGST. )

⇒ 2nd> Then the liability of SGST shall be settled by ITC of SGST. (ITC of SGST shall be first utilized to settle the liability of SGST.)

⇒ 3rd> Then the liability of SGST shall be settled by electronic cash ledger.

Note: The liability of SGST cannot be settled by ITC of CGST/UTGST.

How a liability of Union Territory Tax i.e UTGST be settled?

⇒ 1st > The liability of UTGST shall be first settled by ITC of IGST. (only if there is surplus ITC after settling the liability of IGST. )

⇒ 2nd> Then the liability of UTGST shall be settled by ITC of UTGST. (ITC of UTGST shall be first utilized to settle the liability of UTGST.)

⇒ 3rd> Then the liability of UTGST shall be settled by electronic cash ledger.

Note: The liability of UTGST cannot be settled by ITC of CGST/SGST.

Section 49(5) – Utilization of Input Tax Credit

“(5) The amount of input tax credit available in the electronic credit ledger of the registered person on account of––

(a) the integrated tax shall first be utilized towards payment of integrated tax and the amount remaining, if any, may be utilized towards the payment of central tax and State tax, or as the case may be, Union territory tax, in that order;

(b) the central tax shall first be utilized towards payment of central tax and the amount remaining, if any, may be utilized towards the payment of integrated tax;

(c) the State tax shall first be utilized towards payment of State tax and the amount remaining, if any, may be utilized towards payment of integrated tax;

(d) the Union territory tax shall first be utilized towards payment of Union territory tax and the amount remaining, if any, may be utilized towards payment of integrated tax;

(e) the central tax shall not be utilized towards payment of State tax or Union territory tax; and

(f) the State tax or Union territory tax shall not be utilized towards payment of central tax.”

Section 49A – Utilisation of ITC subject to certain conditions

“Notwithstanding anything contained in section 49, the input tax credit on account of central tax, State tax or Union territory tax shall be utilized towards payment of integrated tax, central tax, State tax or Union territory tax, as the case may be, only after the input tax credit available on account of integrated tax has first been utilized fully towards such payment.”

Section 49B – Order of utilization of ITC under GST

“Notwithstanding anything contained in this Chapter and subject to the provisions of clause (e) and clause (f) of sub-section (5) of section 49, the Government may, on the recommendations of the Council, prescribe the order and manner of utilization of the input tax credit on account of integrated tax, central tax, State tax or Union territory tax, as the case may be, towards payment of any such tax.”.

Rule 88A – Order of utilization of ITC under GST

“Input tax credit on account of integrated tax shall first be utilized towards payment of integrated tax, and the amount remaining, if any, may be utilized towards the payment of central tax and State tax or Union territory tax, as the case may be, in any order:

Provided that the input tax credit on account of central tax, State tax or Union territory tax shall be utilized towards payment of integrated tax, central tax, State tax or Union territory tax, as the case may be, only after the input tax credit available on account of integrated tax has first been utilized fully.”

Related Posts

- 50th GST Council Meeting - 11/07/2023

- GST Compliance Calendar of October 2023 - 01/04/2023

- GST sections amended in Finance Act 2023 - 27/03/2023

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment