Income Tax

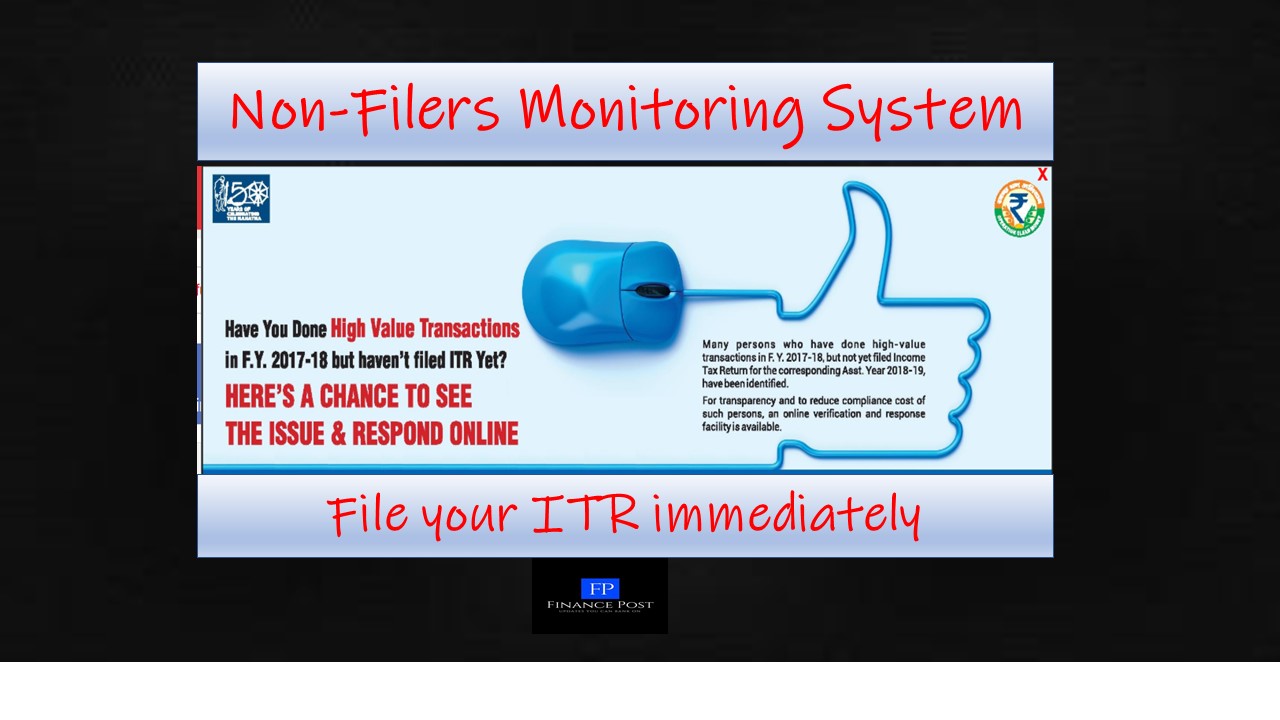

Non-filers Monitoring System (NMS) : Another masterstroke by Govt

Last updated on March 17th, 2021 at 11:23 pmNon-filers Monitoring System (NMS): Another masterstroke by Govt. The current Government is widely appreciated for its implementation of schemes to recover taxes from people. Along with demonetization […]