GST

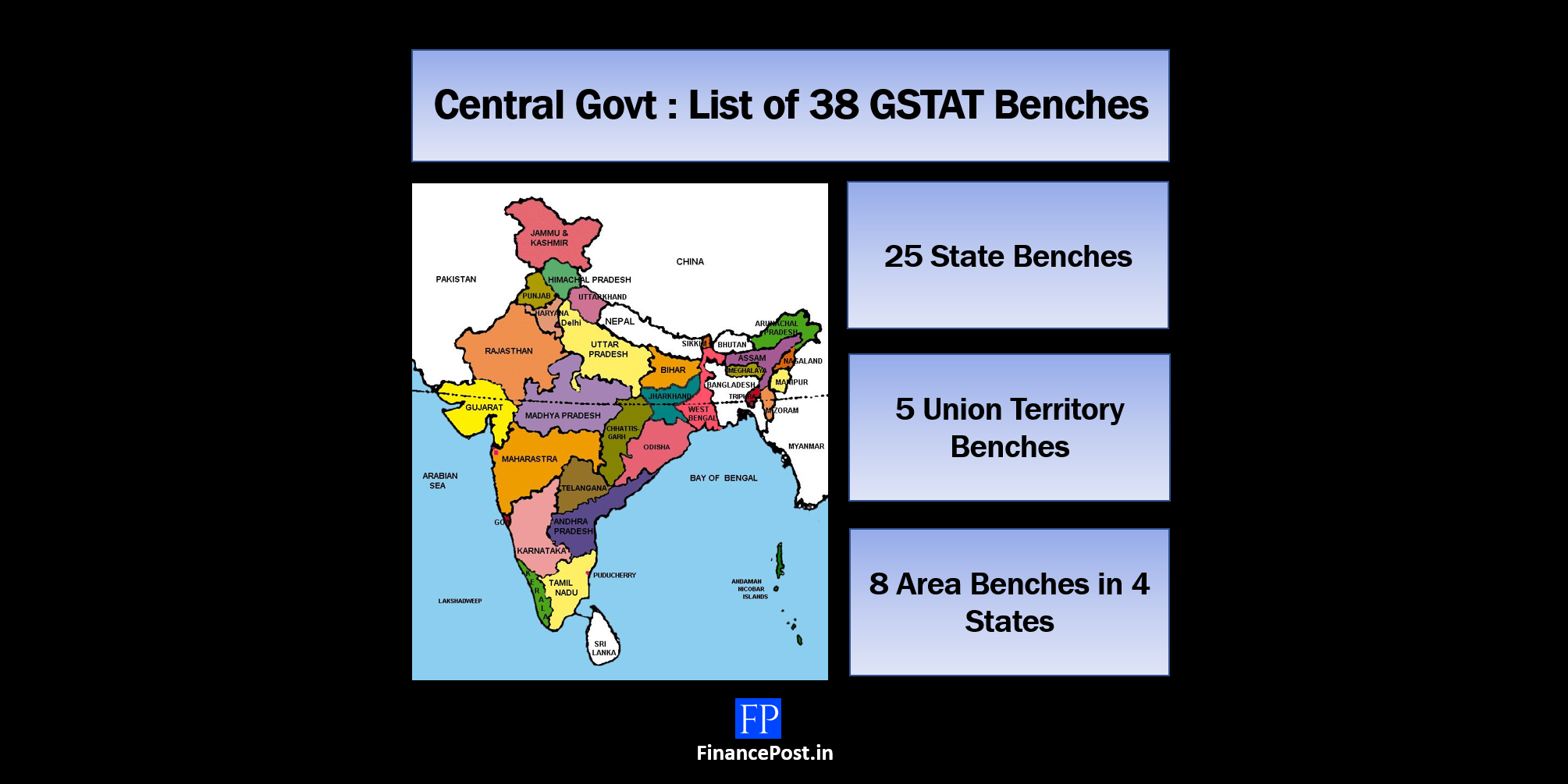

Central Govt: List of 38 GSTAT Benches

Last updated on April 9th, 2021 at 08:40 pmCentral Govt: List of 38 GSTAT Benches Goods and Services Tax Appellate Tribunal (GSTAT) is constituted for hearing appeals against the orders passed by the Appellate Authority […]