GST

GST Compliance Calendar of October 2023

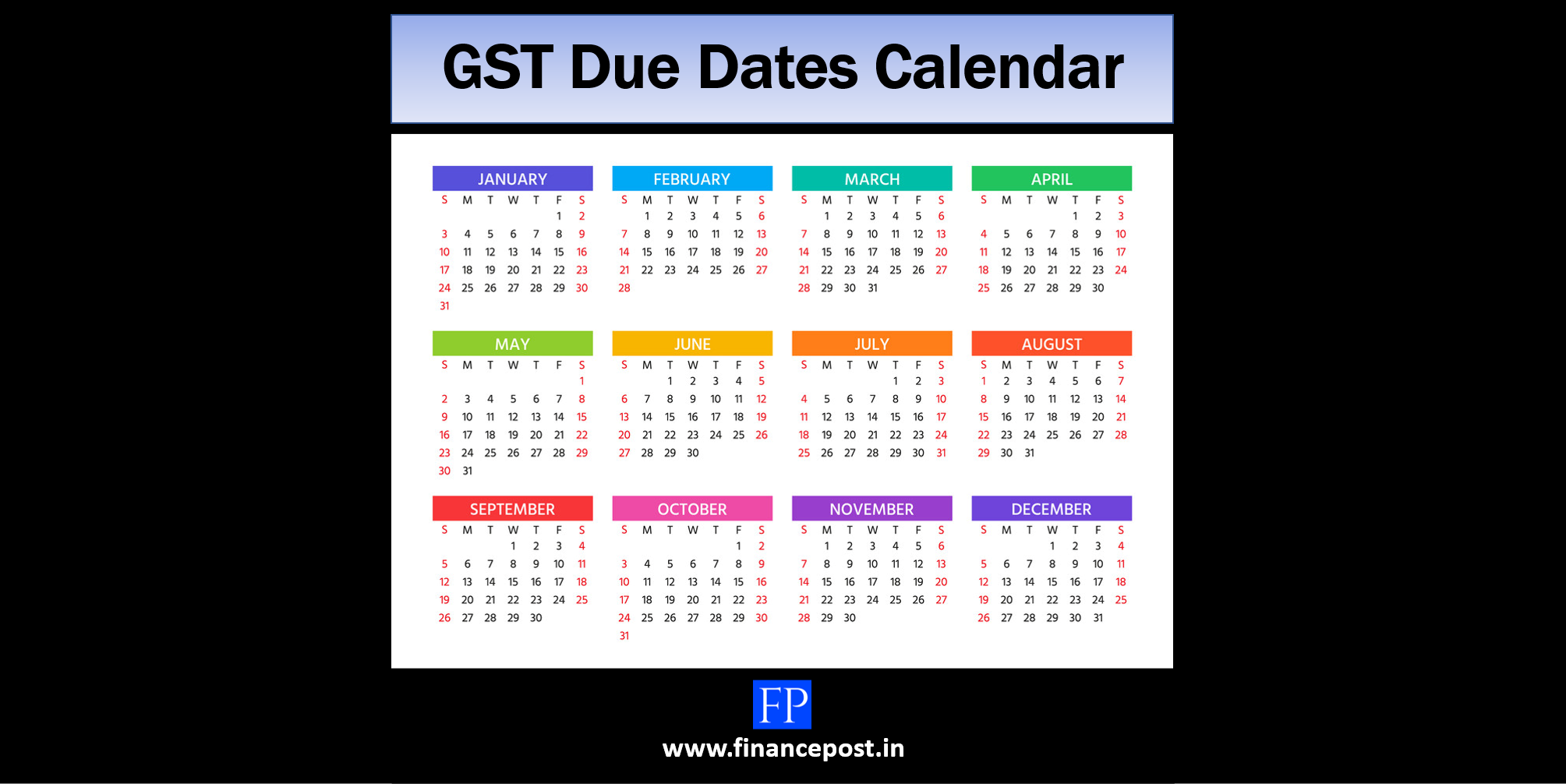

Last updated on September 24th, 2023 at 07:55 pm GST Due Dates Calendar Compliance calendar for the month of October 2023 [su_table] Date GST Return & Payments 10.10.2023 Monthly GSTR 7 for September 2023 (TDS deductor) […]