Last updated on October 6th, 2022 at 08:03 pm

Is RCM applicable?

What exactly is the confusion about the applicability of RCM and what’s the reason behind it?

There is a lot of confusion as to whether RCM will be applicable from 1st February 2019 or not. It will be applicable to what value? It will be applicable to what kind of supplies? It will be applicable to all registered taxpayers? etc. etc.

The reason behind the misconception arising in minds of people is the

CGST(Rate) Notification no. 01/2019 dated 29th January 2019 which states that it seeks to rescind CGST(Rate) Notification no. 08/2017 dated 28th June 2017 in order to bring into effect the amendments regarding RCM on supplies by unregistered persons in the GST Acts.

AND

CGST Notification no. 02/2019 dated 29th January 2019 which states that the CGST (Amendment) Act, 2018 [except for section 8(b), 17, 18, 20(a), 28(b)(i) and 28(c)(i)] which was approved on 29th August 2018 will be effective from 1st February 2019.

What exactly is a reverse charge mechanism?

To put it in simple words, as per the reverse charge mechanism of GST, the recipient of the goods or services is the person liable to pay GST instead of the supplier. (As a supplier is an unregistered person and the recipient is a registered person). The purpose of the reverse charge mechanism was to safeguard the revenue collection of the Government, which would otherwise get impacted as there will be no levy of tax on the supply of goods or services by an unregistered person. Though this provision has not been implemented yet considering the hardships of taxpayers and it has been deferred from time to time.

Series of changes in section 9(4) notified from time to time by Government

[su_table]

| As per section 9(4) of CGST Act 2017 | RCM will be applicable to all the registered persons on all types of supplies of goods or services from an unregistered person |

| As per CGST(Rate) Notification no. 8/2017 dated 28.06.17 | RCM will be applicable only when the aggregate value of supplies received by a registered person from an unregistered person exceeds Rs. 5000 per day. |

| As per CGST(Rate) Notification no. 38/2017 dated 13.10.17 | Provisions of RCM u/s 9(4) were suspended up to 31.03.18. |

| As per CGST(Rate) Notification no. 10/2018 dated 23.03.18 | Provisions of RCM u/s 9(4) were suspended up to 30.06.18. |

| As per CGST(Rate) Notification no. 12/2018 dated 29.06.18 | Provisions of RCM u/s 9(4) were suspended up to 30.09.18. |

| As per CGST(Rate) Notification no. 1/2019 dated 29.01.19 | Provisions of RCM u/s 9(4) will be applicable from 01.02.19 |

| As per CGST Notification no. 2/2019 dated 29.01.19 | CGST (Amendment) Act, 2018 will be applicable which has made changes in the provision of section 9(4) |

| As per section 9(4) of CGST(Amendment) Act 2018 | RCM will be applicable to the specific class of registered persons on the specific category of supplies of goods or services from an unregistered person. |

Conclusion: Provisions of RCM u/s 9(4) will be applicable ONLY after the Government will notify

Till then it is applicable only on paper not practically. |

|

[/su_table]

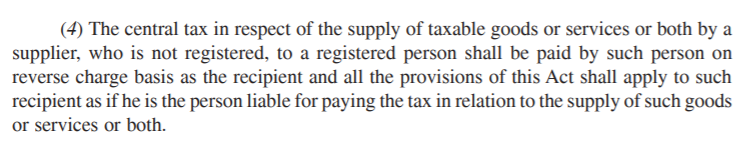

As per section 9(4) of CGST Act, 2017: –

- If any registered person takes any supply of goods or services from an unregistered person then the liability to pay tax arises on the recipient (registered person) on a reverse charge basis.

As per section 9(4) of CGST(Amendment) Act, 2018: –

- If the SPECIFIED category of registered person receives a supply of the SPECIFIED category of goods or services from an unregistered person then the liability to pay tax arises on the recipient (registered person) on a reverse charge basis.

- Though the changes in section 9(4) of CGST (Amendment) Act, 2018 were done on 29th August 2018, due to deferral of the provision it was not made applicable.

Section 9(4) of CGST Act,2017 for reference

Section 9(4) of CGST(amendment) Act,2018 for reference

Conclusion

Applicability of the reverse charge mechanism under section 9(4) is applicable only on paper. It would be interesting to note when and whom will government notify specified persons and which supply of goods or services will it notify to be covered under the reverse charge mechanism. It is uncertain whether there will be a clause for an aggregate value of the transaction per day with an unregistered person or not. As the Govt. has specifically withdrawn notification no. 8/2017 which was related to the aggregate value of supply from an unregistered person to a registered person under GST.

Related Posts

None found

- 50th GST Council Meeting - 11/07/2023

- GST Compliance Calendar of October 2023 - 01/04/2023

- GST sections amended in Finance Act 2023 - 27/03/2023

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment