UDIN: ICAI defers the deadline

Last updated on May 9th, 2021 at 11:14 amUDIN: ICAI defers the deadline Today, ICAI announced that the mandatory use of UDIN has been deferred to 1st Feb 2019. The earlier date was 1st Jan […]

Last updated on May 9th, 2021 at 11:14 amUDIN: ICAI defers the deadline Today, ICAI announced that the mandatory use of UDIN has been deferred to 1st Feb 2019. The earlier date was 1st Jan […]

Last updated on March 17th, 2021 at 10:58 pm31st GST Council Meeting updates After the announcement was made by Prime Minister Modi on Tuesday that all the items which are used by the common man […]

Last updated on August 13th, 2021 at 09:18 pmApplicability of GST on a Co-operative Housing Society The Co-operative Housing Society is a collective body of individuals from the society itself, which is formed for the […]

Last updated on May 15th, 2021 at 09:18 pmPenny Stocks – Multi-baggers or bankrupt? What is a penny stock? A penny stock is a share or stock, trading at a very low price. Generally, stocks with […]

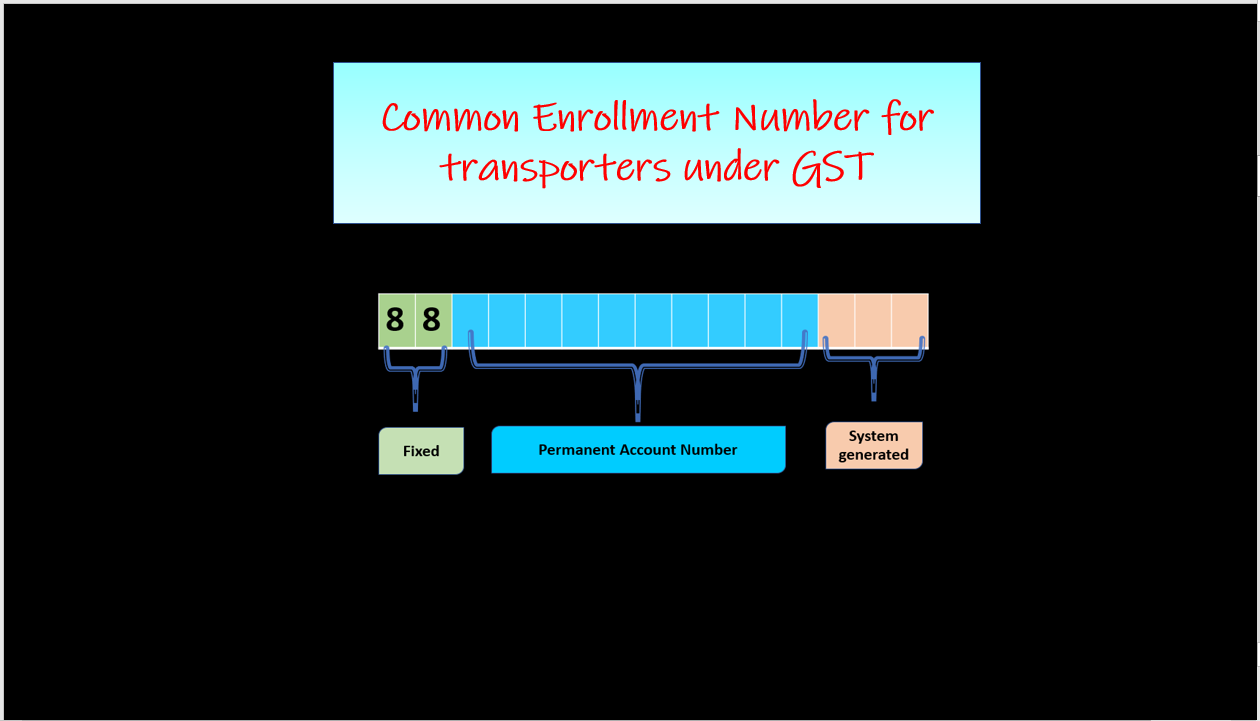

Last updated on March 17th, 2021 at 11:03 pmCommon Enrollment Number for transporters under GST A new facility of a unique common enrollment number with an E-way bill system was launched for the convenience of […]

Last updated on March 17th, 2021 at 11:05 pmApplicability of GST on sale of property The real estate industry is one of the major contributors to the GDP and job creation in the Indian economy. […]

Last updated on May 8th, 2021 at 11:06 pmWhy should RBI be independent? Last month with the news of Govt. invoking Sec 7 the question on the autonomy of RBI was raised. Now with the […]

Last updated on May 16th, 2021 at 08:11 pmRevenue recognition – Differences between GST law and GAAP In the earlier post, we saw various differences between the Accounting Standards / Ind AS and GST Law. […]

Last updated on May 16th, 2021 at 08:10 pmGST and Accounting Standards (AS / IndAS) Differences An accountant or a statutory auditor follows some GAAP for the accounting of the transactions. As mandated by the […]

Last updated on December 1st, 2022 at 07:04 pmGSTR 9A Annual Return for taxpayers registered under composition levy Composition scheme It is a scheme under the GST regime for small taxpayers. Small taxpayers under GST […]

Copyright © 2025 | MH Magazine WordPress Theme by MH Themes