Income Tax

Deduction u/s 80IC of Income Tax Act

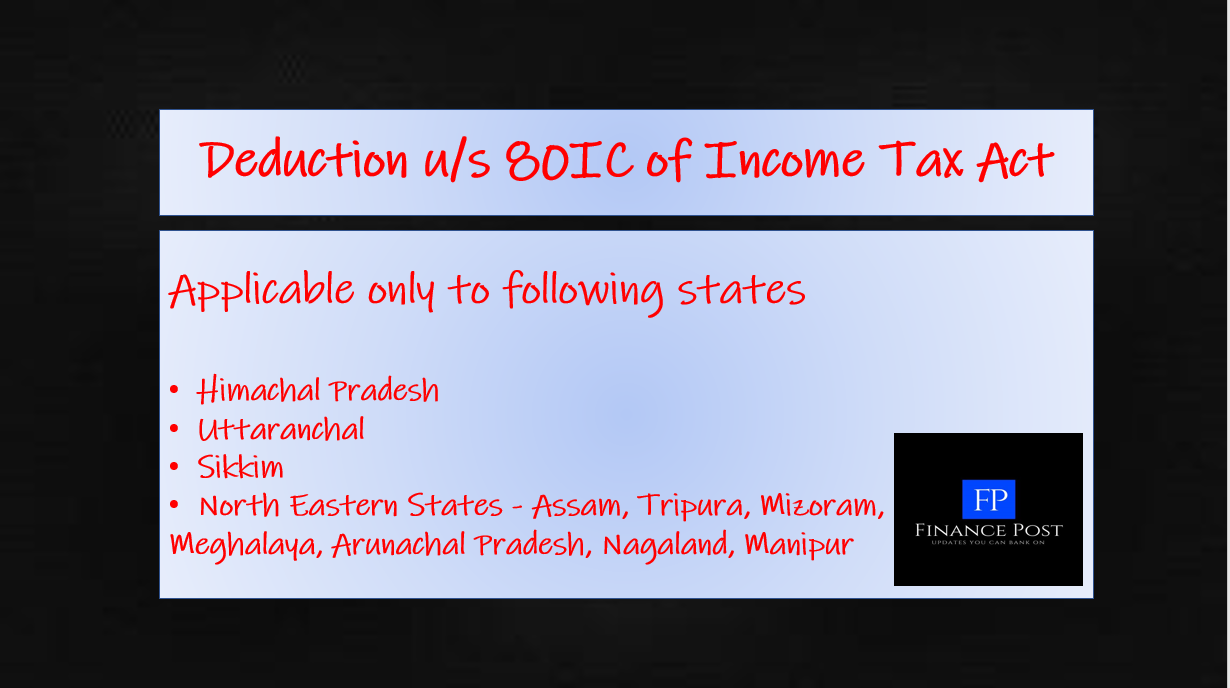

Last updated on July 24th, 2022 at 08:07 pmSection 80-IC: Deduction in respect of certain undertakings or enterprises in certain special category states History This Section was introduced by Finance Act, 2003, and will be […]