Last updated on July 24th, 2022 at 08:16 pm

Some FAQs related to the filing of Income Tax Return

31st July is the deadline to file the ITR for most of the tax-payers including salaried people. The filing Income Tax Return (ITR) has been simplified and the awareness has been increased. However, still, many people face issues or have questions related to filing the tax return. We aim to provide answers to some common questions.

Who is required to file an income tax return in India?

Any person who earns the income taxable in India is required to file Income Tax Return in India. We list down the following circumstances in which a person should file an income tax return.

- If your gross total income (before allowing any deductions under section 80C to 80U) is more than Rs 2.5 lakhs ( RS. 3 Lakhs in case of citizens aged 60 or above but less than 80 and Rs 5 lakhs in case of citizens aged above 80).

- If you are a Company or Firm; you must file a tax return irrespective of whether you earn profit or loss.

- If you hold PAN or have been filing tax returns earlier, it is advisable to keep filing your tax return.

- If you want to claim a refund from the income tax department.

- If you want to carry forward a loss under a head of income

- Every Resident individual holding an asset or financial interest in an entity located outside of India must file a tax return.

- If you receive any income derived from property held under a trust for charitable or religious purposes or from a political party or from a research association, news agency, educational or medical institution, trade union, etc. You must file a tax return.

- Even foreign companies taking treaty benefit on a transaction in India, need to file a tax return.

- If any tax has been deducted from your income, it is advisable to file a tax return to avoid any notices from IT department.

- Many times, loan applications or visa applications require IT returns as proof.

The Finance (No.2) Bill, 2019, has widened the scope of mandatory filing of return by Individual, HUF, AOP, etc. As per the proposed amendment, Individual, HUF, AOP, BOI, artificial juridical person shall be required to file the return even if their total income is below the maximum amount not chargeable to tax, in case such person:

- has deposited an amount exceeding Rs. 1 crore in one or more current accounts maintained with a bank including co-operative bank OR

- has incurred expenditure exceeding Rs. 2 lakhs for himself or any other person for travel to a foreign country OR

- has incurred expenditure exceeding Rs. 1 lakh towards the consumption of electricity.

Is it mandatory to file a tax return even if my business is suffering losses? or Is it mandatory to file a tax return even if my employer has deducted and deposited the requisite tax?

Yes. Many people feel that their tax has been deducted by the employer. Hence there is no need to file a tax return. Some also believe that the companies incurring losses are not liable to pay taxes and hence not required to file a tax return. However, that’s not true. If you fall in any of the categories mentioned above, you must file a tax return.

Is the linking of PAN and Aadhar mandatory?

Yes. There has been a lot of issues from the time Aadhar linking with PAN was mandated last year. Supreme Court in its verdict on checking constitutional validity on such linking finally said that Aadhaar is a must to file income tax returns (ITR) and to apply for a new PAN. (Click here to read the Aadhar Verdict). CBDT has accordingly extended the time to link PAN with the Aadhar card till 30 September 2019.

The Finance (No.2) Bill, 2019 proposes to provide for interchangeability of PAN with the Aadhaar Number. Accordingly, a person who is required to quote his PAN under this Act and who has not been allotted a PAN but possess the Aadhaar Number can quote his Aadhaar Number instead of PAN. Such person on the basis of the Aadhaar Number quoted shall be allotted PAN. Thus, the Aadhaar Number and PAN

will get linked automatically. It is to be noted that Aadhaar Number can be quoted only by such a person who has not been allotted PAN. Further amendments are made to invalidate PAN in case of non-linkage with Aadhar. Accordingly, existing PAN will still be required to be linked with Aadhaar Number. In case of non-linkage, the PAN will become inoperative.

What are the due dates to file ITRs?

The income tax department of India has determined the due dates to file income tax returns based on the categories of tax-payers. The dates differ from 31st July, 30th Sep or 30th Nov. depending on the type of tax-payer you are. Click here to know the details and determine your due date to file a tax return.

Is it mandatory to file an income tax return “online”?

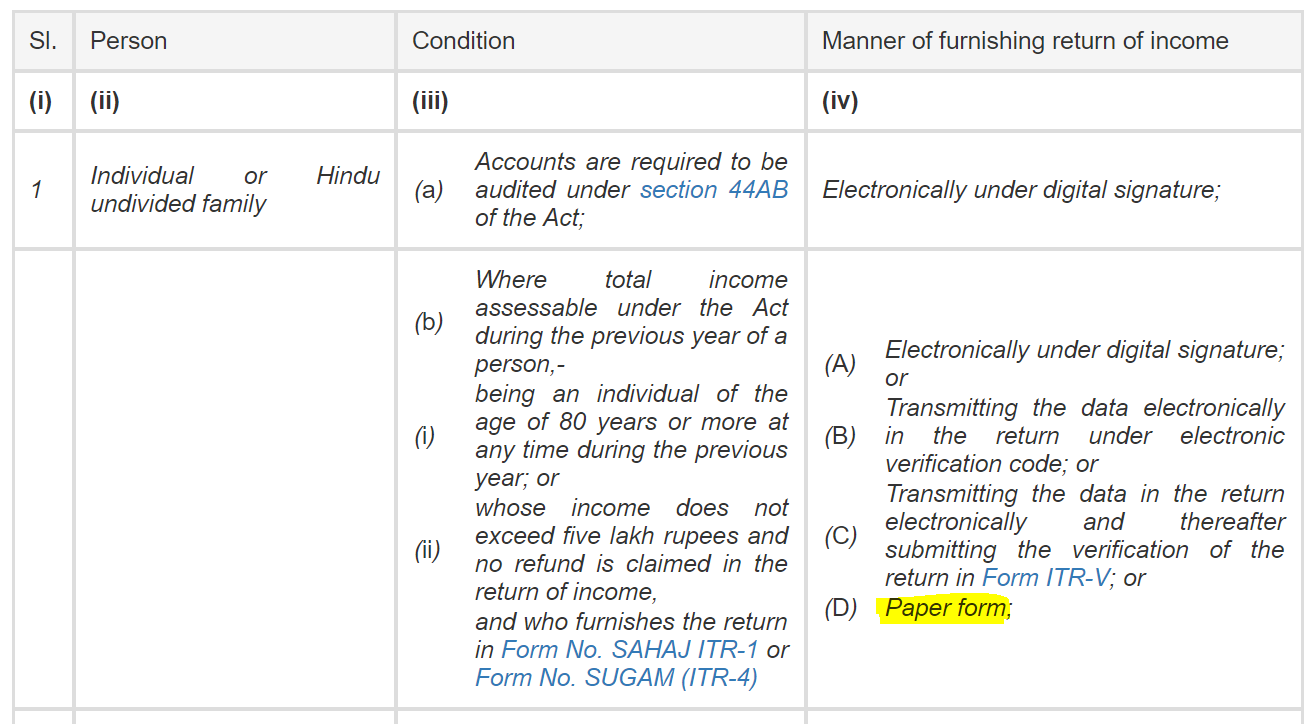

The income tax department has made it mandatory to file the income tax returns online for all the registered taxpayers with taxable income. However, in the case of the following taxpayers, the tax department has provided an option to file the tax return in “paper form” instead of e-filing:

- An individual of the age of 80 years or more at any time during the previous year OR

- An individual or HUF whose income does not exceed Rs. 5 lacs and no refund is claimed in the return of income and who furnishes the return in ITR 1 or ITR 4.

Which ITR should I file?

The income tax department has specified the different ITR forms for different categories of tax-payers and also based on their the category of taxable income. Click here to read about it in detail and determine the ITR applicable to you.

- How to do a transaction in Digital Rupee (CBDC-R)? – A Step by step Guide - 10/12/2022

- Can you rectify your 26AS? - 20/09/2022

- Tax implications on Cashback - 09/09/2022

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment