TCS ON SALE OF GOODS – NEW PROVISION

Last updated on May 9th, 2021 at 10:20 pmTCS ON SALE OF GOODS – NEW PROVISION TCS (Tax Collected at Source) is a tax that is collected by the seller from the buyer and deposited […]

Last updated on May 9th, 2021 at 10:20 pmTCS ON SALE OF GOODS – NEW PROVISION TCS (Tax Collected at Source) is a tax that is collected by the seller from the buyer and deposited […]

Last updated on May 9th, 2021 at 10:22 pmWhat is better WILL or TRUST? Succession planning is important as it will make the smooth disposal of the property or estate after the death of the […]

Last updated on May 9th, 2021 at 10:29 pmFloating Rate Savings Bonds, 2020 Government of India has notified the issue of Floating Rate Savings Bonds,2020 (Taxable) vide a F. No. 4(10)-B(W&M)/2020. These bonds are known […]

Last updated on May 9th, 2021 at 10:49 pmSuccession planning through WILL WILL is a legal document that reflects the desire of a person as to how he/she wishes to manage and/or distribute the assets […]

Last updated on May 9th, 2021 at 10:50 pmChanges in Form 26AS – Annual Information Statement (w.e.f. 1st June 2020) The government has introduced Rule 114-I in Income Tax Rules where Form 26AS has become […]

Last updated on May 9th, 2021 at 11:01 pmCBDT provides relaxation for application of lower/NIL deduction TDS certificates w.r.t. FY 2020-21 Due to the outbreak of the COVID-19 pandemic and the lockdown has caused disruption […]

Last updated on May 9th, 2021 at 11:04 pmCompanies Fresh Start Scheme, 2020 The government has issued a General Circular No. 12/2020 dated 30th March 2020 in order to revive the non-compliant companies. As per part […]

Last updated on August 2nd, 2021 at 05:11 pmStandard Deduction for salaried Individuals It is a deduction allowed to salaried individuals. It is mainly a flat amount that is subtracted from the salary income before […]

Last updated on June 9th, 2021 at 09:40 pmIncome Tax Slab Rates – FY 20-21 (AY 21-22) Taxpayers were given an option to choose between the existing/old tax regime or a new/alternate tax regime in […]

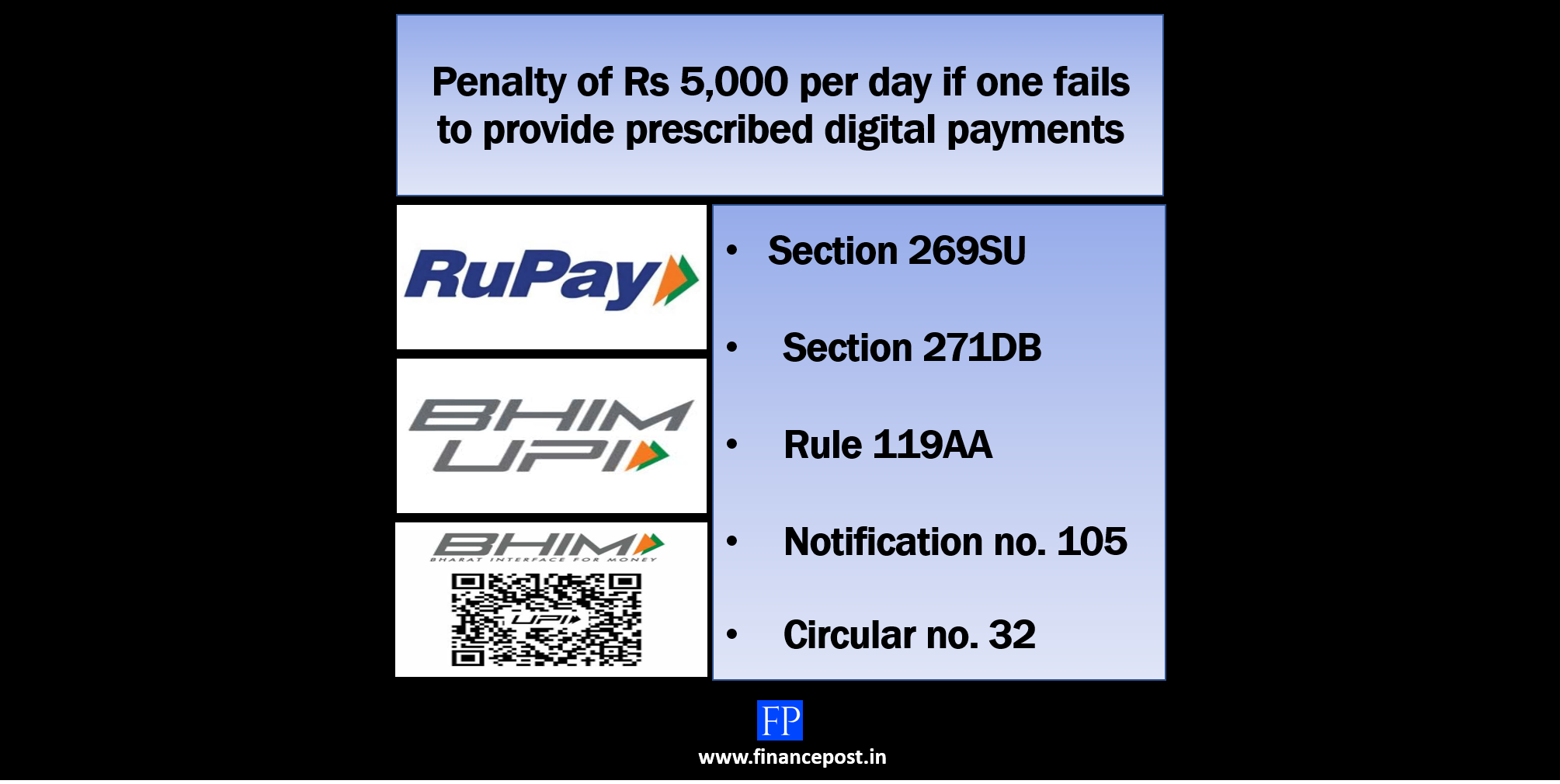

Last updated on April 2nd, 2022 at 01:17 pmPenalty of Rs 5000 per day for non-compliance with section 269SU by 31st January 2020 Businesses having a turnover of more than Rs. 50 cr. in the […]

Copyright © 2025 | MH Magazine WordPress Theme by MH Themes