GST

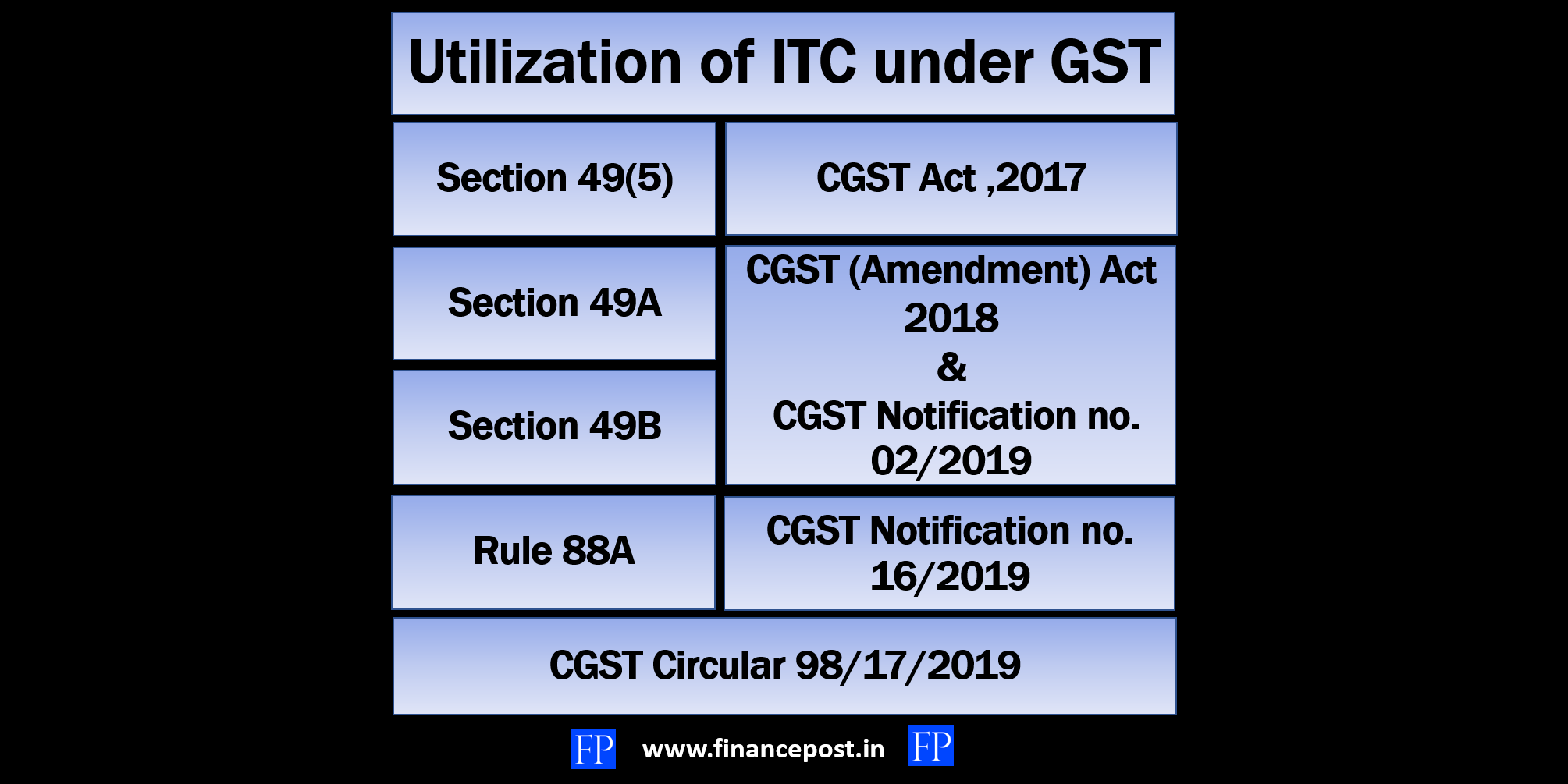

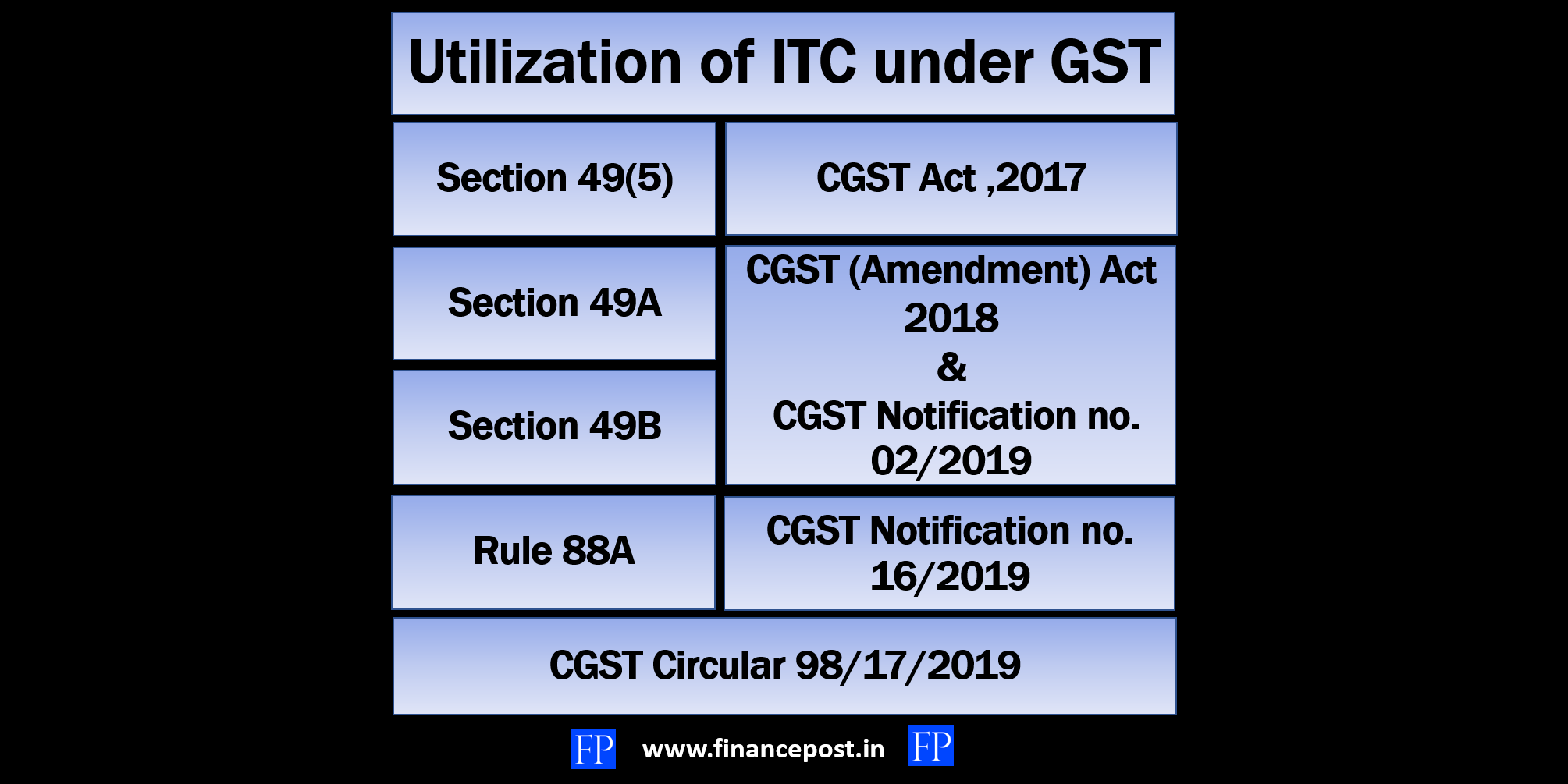

Utilization of ITC under GST

Last updated on March 31st, 2021 at 03:07 pmUtilization of ITC under GST Overview As per the CGST Act, 2017 – The order of utilization of ITC was as per section 49(5). As per CGST […]

Last updated on March 31st, 2021 at 03:07 pmUtilization of ITC under GST Overview As per the CGST Act, 2017 – The order of utilization of ITC was as per section 49(5). As per CGST […]

Copyright © 2025 | MH Magazine WordPress Theme by MH Themes