Income Tax

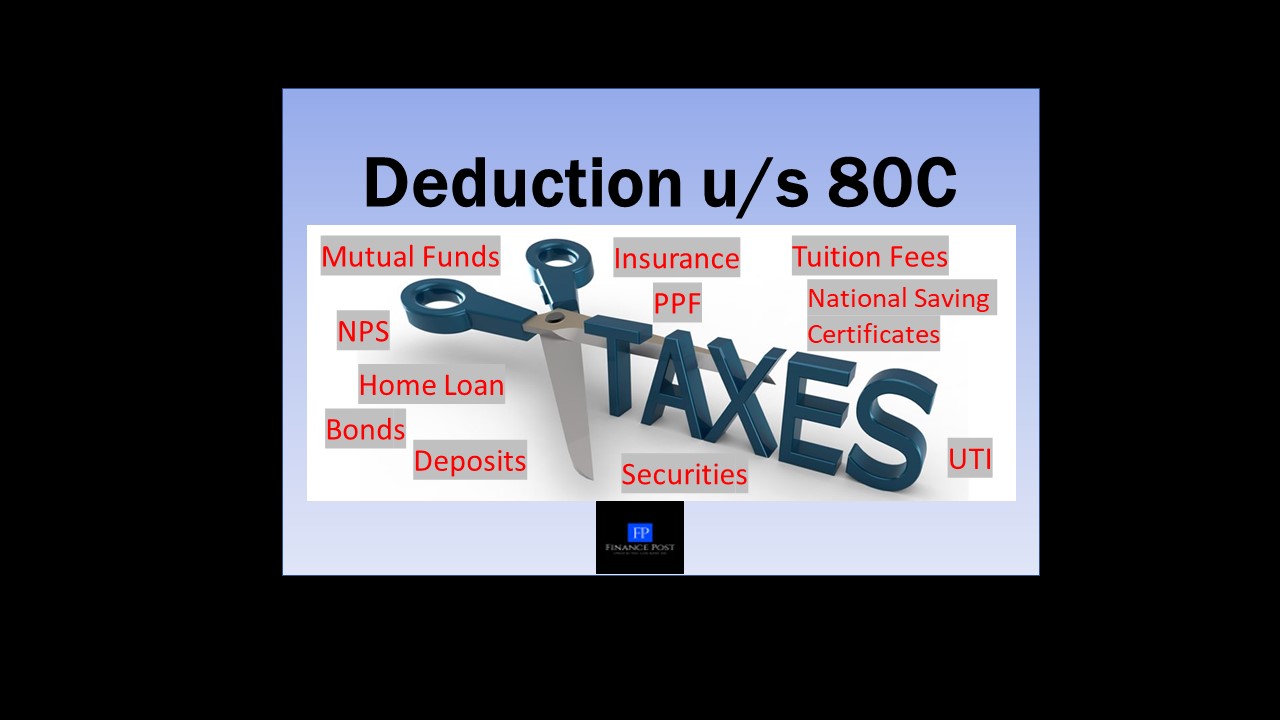

Income Tax Benefit u/s 80C

Last updated on May 9th, 2021 at 01:49 pmIncome Tax Benefit u/s 80C All the individuals and Hindu Undivided Family (HUFs) can avail income tax benefit for certain payments. These benefits are listed under sections […]