Last updated on March 17th, 2021 at 11:03 pm

Common Enrollment Number for transporters under GST

A new facility of a unique common enrollment number with an E-way bill system was launched for the convenience of transporters who are running their business in multiple states with the same permanent account number. Upon various requests from transporters, CBIC had issued a notification no. 28/2018 dated 19th June 2018 to amend the CGST Rules and accommodate the change. This will enable the transport organization to have a centralized system for generating & updating e-way bills throughout the country. With the help of the enrolment number, Part – B can be updated from any of its branches, throughout the country, without further changing the transporter number.

Such transporters have different GSTINs for different states issued under the same PAN. This will also reduce the burden of managing multiple registrations on the e-way bill portal. Compliance with the e way bill system for such transporters is time-consuming with an added cost at the same time it is more prone to mistakes such as the assignment of e-way bills to other transporters, uploading details of detention of vehicles, etc.

Who can obtain the common enrollment number with the e way bill system?

A transporter who has more than one GSTIN as he is registered in more than one State or Union Territory having the same Permanent Account Number can obtain the common enrollment number with the e way bill system.

What is the common enrollment number?

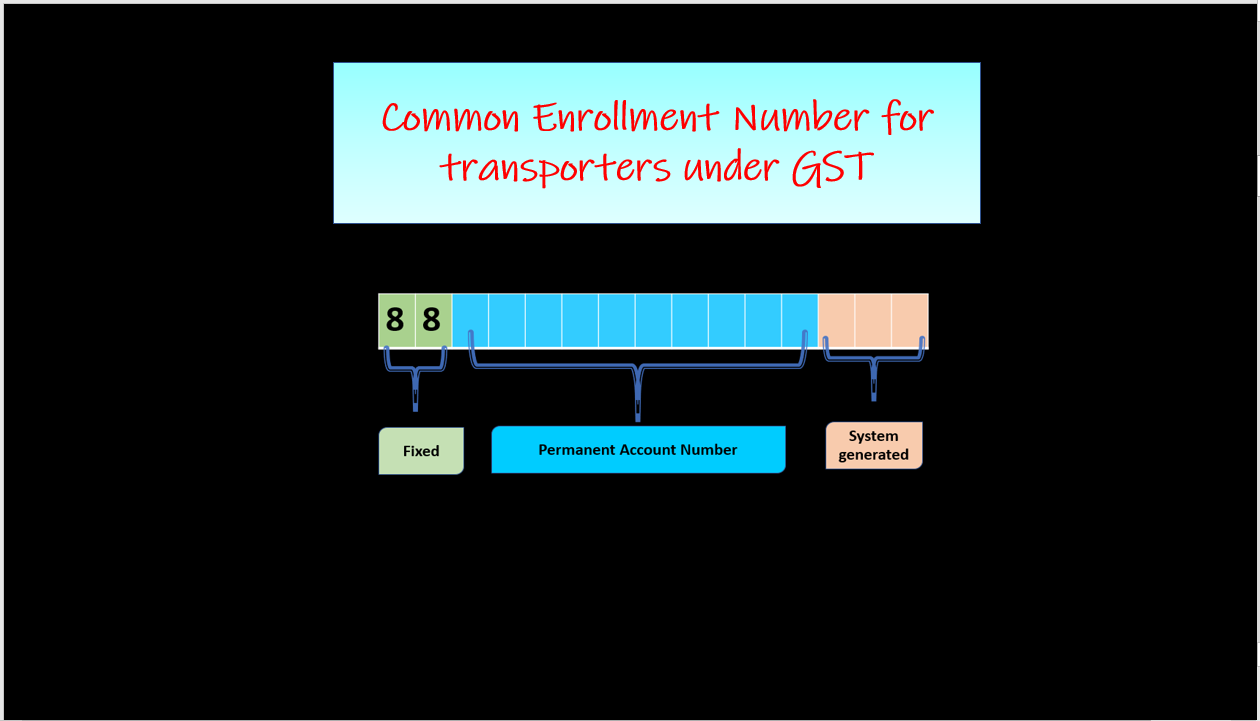

The common enrolment number will be valid throughout the country. It will be a 15-digit number which will be as follows

This unique common enrolment number shall be used by the transporter as Transporter-number in the e-waybill system.

How to obtain the common enrollment number?

The transporter will have to apply by providing the details in FORM GST ENR-02 using any one of his Goods and Services Tax Identification Numbers online using the common portal. Details like Legal name, PAN, GSTIN of different states, respective trade names, and state are required by the above form.

After the details furnished in FORM GST ENR-02 are validated, System will generate a unique common enrolment number which will be communicated to the applicant transporter.

Can the transporter continue to use the GSTIN for generating an e way bill?

No, After the receipt of a unique common enrolment number, the transporter will not be eligible to use any of the GSTINs for generation or updating of e waybill. It is mandatory to use the unique common enrolment number for any e-way bill transaction. The transporter will also be required to communicate the common enrolment number to his clients for future use as transporter number while generating e-way bills

Note: A transporter can continue to use the old GSTIN for a period of 10 days and subsequently these GSTINs will be blocked for the transporter number updation.

Note: The transporters are also required to submit the final report after the e-Way Bill is generated. As per new rules, an extension of up to three days to file the final report.

Can a transporter create multiple login accounts for a common enrolment number?

Yes, the transporter can create multiple login accounts for a common enrolment number and share them with his/her branches throughout the country which will make it easy to update the details in Part-B in the e-way bills.

A specimen of FORM GST ENR-02

[su_table]

FORM GST ENR-02[See Rule 58(1A)] Application for obtaining unique common enrolment number[Only for transporters registered in more than one State or Union Territory having the same PAN] [su_table]

[/su_table] 2. Details of registrations having the same PAN [su_table]

[/su_table] 3. Verification I hereby solemnly affirm and declare that the information given herein above is true and correct to the best of my knowledge and belief and nothing has been concealed therefrom.

Signature

Place: Name of Authorised Signatory ….…………………… Date: Designation/Status…………………… For office use – Enrolment no. – Date –………………………………… |

[/su_table]

You may also like:

- What are the changes in the e-way bill effective from 16th November 2018?

- What are the changes in the e-way bill applicable from 1st October 2018?

- What is CESS Non-Advol?

- Click here to understand the process of moving the consignment of one e-way bill in multiple vehicles from the transshipment place to reach the destination

- Click here to understand the process of issuing bulk e way bill issued on e way bill portal

- Click here FAQs on e-way bill system issued on e way bill portal

- 50th GST Council Meeting - 11/07/2023

- GST Compliance Calendar of October 2023 - 01/04/2023

- GST sections amended in Finance Act 2023 - 27/03/2023

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

Be the first to comment