GST

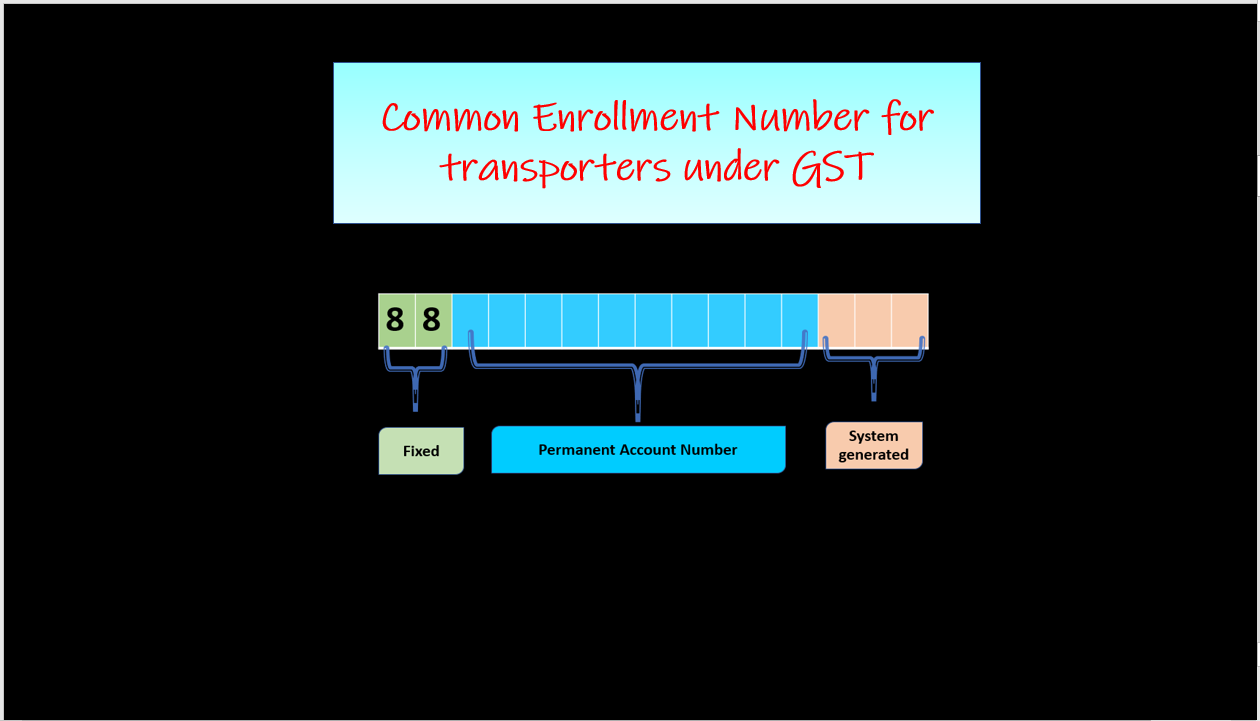

Common Enrollment Number for transporters under GST

Last updated on March 17th, 2021 at 11:03 pmCommon Enrollment Number for transporters under GST A new facility of a unique common enrollment number with an E-way bill system was launched for the convenience of […]