Last updated on March 13th, 2023 at 06:10 pm

So far, the Government had no option to find out whether the claims of deductions u/s 80G made by the taxpayer were correct or not. In order to bring transparency to the system, CBDT issued a notification no. 19/2021 dated 26th March 2021 to notify a Form 10BD to be filed by specified institutions providing specific details of donations made by donors and notify a Form 10BE certificate of donation which taxpayers will require to claim the deduction u/s 80G.

You may like – Deduction in respect of donation to Political Parties

Form 10BD is a statement of donations received to be filed mandatorily as per section 80G(5)(viii) and as per section 35(1A)(i). It shall be furnished electronically using DSC or EVC.

Note: If no donation is received during the financial year, the above form is not needed.

Note: A corrected statement can be submitted for rectifying any mistake or to add, delete or update the information furnished in Form 10BD.

Note: Details from Form 10BD will reflect in Form 26AS and AIS.

Form 10BD is to be filed by the following:-

Institutions or Funds referred to in section 80G(2)(a)(iv)

In simple words, such Institutions or Funds are registered u/s 80G(2)(a)(iv) and eligible to collect donations and issue receipts for claiming the deduction under section 80G.

Note: Names of such institutions or funds are not specifically listed/included in the list of institutions or funds created by the Government and prescribed in section 80G. For e.g. National Defence Fund was set up by the Central Government, National Children’s Fund, etc.

Institutions incurring expenditure on research specified u/s 35(1) (ii)/(iia)/(iii)

Section 35(1)(ii) – An institution/association/university/college approved and notified by the Central Government has the main objective of undertaking scientific research.

Section 35(1)(iia) – A company registered in India and approved by the prescribed authority has the main objective of undertaking scientific research and development.

Section 35(1)(iii) – An institution/association/university/college approved and notified by the Central Government has the main objective of undertaking research in social science or statistical research.

The last date to submit the statement in Form 10BD is 31st May immediately following the end of the financial year in which the donation was received.

As per section 234G – Late fees of Rs. 200/- per day of delay. However, the maximum late fees should not exceed the amount of the donation.

As per section 271K – Failure to file Form 10BD will attract a minimum penalty of Rs 10,000/- and a maximum penalty of Rs 1,00,000/-.

YES

As this will be a crucial record for the donors in order to claim a deduction under the respective section. If an error was made in filing Form 10BD by the charitable organizations then the option to revise the form shall be given by CBDT.

There is no restriction on filing Form 10BD. It can be filed as many times as it is required.

Form 10BD is to be filed by every institution having approval under section 80G or section 35 and that has received donations. It is irrelevant whether the institution has provisional approval or regular approval.

In case if revised Form needs to be filed the same form needs to be filed but you need to select “revised” and not “original” and you need to enter the ARN to revise the form.

If the same donor, the same mode of payment, and the same type of donation and under the same section then you can consolidate the same and show it as one entry.

Trust/NGO (Donee) can revise Form 10BD only up to 31st May from the end of the financial year.

There is no clarity as to how donors will be able to claim the deduction u/s 80G if an incorrect PAN was given by the donor/ incorrect PAN was reported by the donee as Trusts/NGO(Donee) will not have the option to revise it post 31st May.

Trusts & NGOs are required to report the donations received in kind. Reasonable/fair measures should be used to ascertain the monetary value of donations in kind as there is no specific rule prescribed for valuation.

Note: As per explanation 5 to section 80G, donors will not be eligible to claim deductions u/s 80G for donations in kind.

Every amount of donation received needs to be reported in Form 10BD. As the threshold limit is not defined, reporting is required for even small or penny donations.

Every amount of donation received needs to be reported in Form 10BD. Foreign currency donation needs to be converted at the exchange rate on the date of receipt. It is advisable to

Note: Foreign donations should comply with the provisions of Foreign Contribution(Regulation)

Act. A tax identification number should be obtained from the foreign donor.

Trust/NGO should make an effort to get at least one of the identification details of the donor. But in case if that is not possible and feasible then such donations will be considered anonymous donations.

As per section 115BBC of Income Tax Act, 1961 – Any voluntary contribution referred u/s 2(24)(iia) where the donee(Trust/NGO) does not maintain a record of identification details of the person making such contribution.

Anonymous donation needs to be reported in Form 10BD. Note: As per the advisory issued by ICAI, donations received in digital mode should not be reported as anonymous donations.

NO.

If Trust/NGO has not received any donation or grant in the financial year then it will not be mandatory to file Form 10BD for that financial year. As of now, there is no provision to file Nil Form 10BD.

NO.

Donations received in offering box “Hundi” at religious places like temples, gurudwara, churches, mosques, etc. are not required to be reported in Form 10BD. As it is not possible to ascertain the details of donors(devotees) and their respective donations.

Section 15BBC(2) of the Income Tax Act,1961 specifically excludes such donations from the purview of anonymous donations.

Updated Form 10BD as amended by Income-tax (Fourteenth Amendment) Rules, 2022 notified vide a CBDT Notification no. 51/2022 dated 9th May 2022

In the case of original Form 10BD – Pre acknowledgment number needs to be left blank, as it will be generated after the form is filed.

In the case of revised Form 10BD – Pre acknowledgment number generated after the filing of the original Form 10BD needs to be mentioned.

For the unique identification number of the donor in the Form 10BD following shall be filed

> If PAN or Aadhaar number is available, then it is mandatory to use one from both.

> If neither PAN nor Aadhar number is available, then one of the following can be used

– Taxpayer Identification Number of the country where the person resides.

– Passport number

– Elector’s photo identity number

– Driving License number

– Ration card number

Type of Identification – ID Code

Permanent Account Number – 1

Aadhaar Number – 2

Taxpayer Identification Number of the country where the person resides – 3

Passport number – 4

Elector’s photo identity number – 5

Driving License number – 6

Ration card number – 7

Generally, the section code will be the same for a donee (Trust/NGO/Institutions).

Donors will be eligible to claim a deduction for the donation needs to be selected from the following drop-down list

a) Section 80G

b) Section 35(1)(iia)

c) Section 35(1)(ii)

d) Section 35(1)(iii)

Unique Registration Number is the number mentioned at the Sr. No. 5 of Form 10AC in the Order for registration or provisional registration or approval or provisional approval.

i.e. Provisional Approval Number/Provisional Acknowledgment Number or Unique Registration Number.

The date of Issuance of URN will be the date of registration/ approval/ provisional registration/ provisional approval (Sr. No. 5 in Form 10AC).

Based on the type of donation received one from the following needs to be selected from the drop-down list

a) Corpus

b) Specific grant

c) Others

Based on the mode of donation received one from the following needs to be selected from the drop-down list

a) cash

b) kind

c) Electronic modes including account payee cheque/draft

d) Others

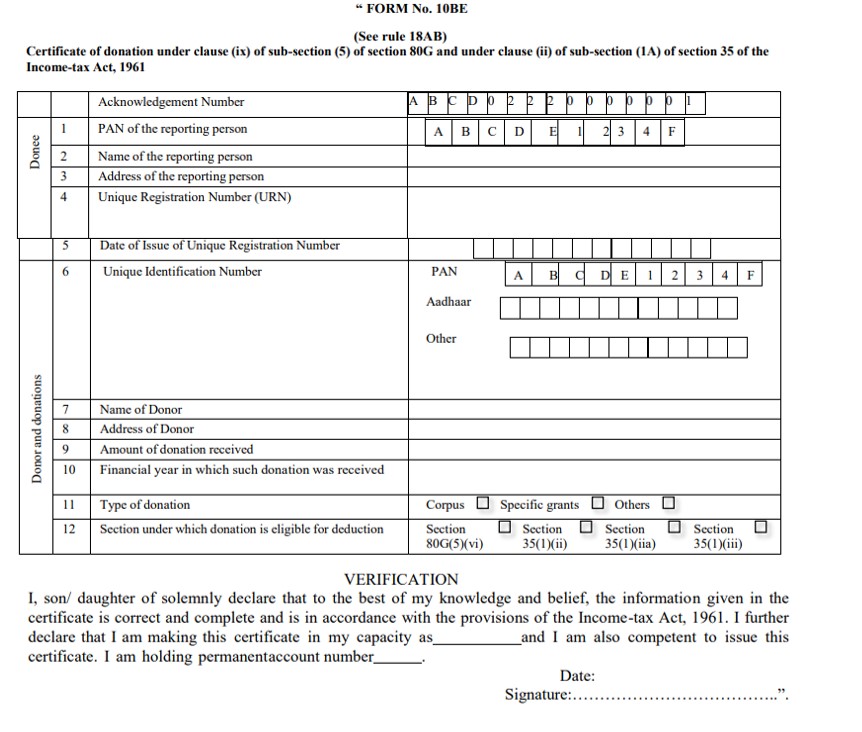

After filing the statement of donations in Form 10BD, the above-mentioned institutions have to download the certificate in Form 10BE and provide the same to donors.

The last date to issue a certificate to the donor in Form 10BE is 31st May immediately following the end of the financial year in which the donation was received.

Updated Form 10BE as amended by Income-tax (Fourteenth Amendment) Rules, 2022 notified vide a CBDT Notification no. 51/2022 dated 9th May 2022

> It can be downloaded after 24 hours of filing Form 10BD any number of times.

- 50th GST Council Meeting - 11/07/2023

- GST Compliance Calendar of October 2023 - 01/04/2023

- GST sections amended in Finance Act 2023 - 27/03/2023

Disclaimer: The above content is for general info purpose only and does not constitute professional advice. The author/ website will not be liable for any inaccurate / incomplete information and any reliance you place on the content is strictly at your risk.

Follow us on Social Media by clicking below

Follow @financepost_in

If we do not have the information of all the donors and we do not have the details of those who give secret donations, then how will we file this form?

I think from AY 2022-23, taxpayers who have given such secret donations will not be able to claim the deduction u/s 80G.

These donations may also be considered as annonmous donations where identity of the donor is not available.

Yes

Whether form 10BD applicable for Donation received by politicaly party covered u/s80GGC

No, it is not applicable to political party and deduction to be claimed u/s 80GGC

Dear Sir/Ma’am,

I have received many donation of amount less than rupees 1000. Do I need to show those donations in FORM 10BD?

There is no minimum amount specified for which Form 10BD needs to be filed which means you need to file it for every donation receipt. Certainly, the donors would claim it as a deduction u/s 80G while filing their ITR.

Sir,

1.Where donations received are less than Rs.2000/- and donors have not given their PAN NUMBERS to the DONEE CHARITABLE TRUST, is Trust required to give their names IN FORM 10BD, as No certificate can be issued to them which entitle them DEDUCTION OF REBATE UNDER SECTION 80 G of the ITAct, 1961.

2. As donors who have given more than Rs.2000/- as donation to charitable trust are not entitled to any rebate under the ITAct,1961, can Trust exclude their names in form 10BD.

3. Can Trust give names and addresses of donors who have given payment by cheque OR

ELECTRONICALLY exceeding Rs.2000/- and their PAN NUMBERS TO THE TRUST AND EXCLUDES OTHERS WHO HAVE PAID MORE THAN RS.2000/- in cash to the DONEE CHARITABLE TRUST.

Kindly reply urgently

Based on whatever information is available regarding Form 10BD,

1. If you have any of the below-mentioned detail of the donor you can mention that while filing Form 10BD.

Aadhaar, PAN, Passport, Ration Card number, Driving License number, Voter’s ID Card number, Taxpayer Identification Number of the country

where the person resides.

2. In our opinion, it is advisable for you as Trust to provide all details available with you of the donor whether the donation was in cash, cheque, electronic mode, kind, etc

3. If a donor has paid more than Rs 2000 in cash they will not be allowed to claim a deduction but you should intimate the correct details to Government in Form 10BD.

Whether anonymous donations to be filled in form 10BD?

What to filled under unique identification number of the donar?

In our opinion, you need not report anonymous donation in Form 10BD.

In “Unique identification number of the donor”, one of the following shall be filled:

a. If PAN or Aadhaar number is available, one of that should be mandatorily filled.

b. If neither PAN or Aadhaar is available, one of the following should be filled:-

– Taxpayer Identification Number of the country where the person resides.

– Passport number

– Elector’s photo identity number

– Driving License number

– Ration card number

We are running a charitable trust. We have the 10AC. If some companies give money to sponsor an event or to place advertisment in the magazine published by the trust, how to report in 10BD. What will happen if the company which gives money treats as an expenditure fully for advertisement or promotion. In other words, they may not claim under 80G, but treat as expenditure for promotion.

The answer lies in what kind of receipt was issued by Charitable Trust when the company gave money to sponsor the event or publish an advertisement in the magazine? I believe it would be a donation receipt only then certainly you need to report the same in Form 10BD irrespective of the fact that the company shows it as expenditure or donation.

In form 10BD, unique reg. no. of the donee is to be filled , right?

Yes. Details for the same are provided in the article.

1.is donation received through cheque by trust mode of donation to declared as electronic payment?

2.How details of 10BD reflect in 26 As ais

1. Electronic payment

2. As this is the first year for Form 10BD, can’t comment on how the information will reflect in Form 26AS or AIS. But we believe it will reflect like other details are displayed for a taxpayer.

Whether the amount was given to trust to its bank account? or whether the amount was paid by the sponsor directly to the magazine or advt company? This needs to be considered. If the amount was given to trust and if they have given a 80G donation form to the trust which clearly says the donation is towards corpus of the trust and it was deposited in the trust bank account meant for corpus, only then it becomes donation under 80G.

trust received donation from company under CSR activity is this required to report under form 10BD.

ALL THE DONATION RECEIVED BY TRUST FROM DONOR IS REQUIRED TO FURNISH UNDER 10BE OR ONLY THE DONATION RECEIVED FROM DONOR AND IN RETURN 80G RECEIPT ISSUE TO DONOR ARE REQUIRED TO FURNISH UNDER 10BD

The company will not be eligible to claim the CSR expenses as donations u/s 80G. But Trust will have to show it as a specific grant under donation type for CSR funds received by them.

Trust needs to file details of all the donations received in Form 10BD. The government will treat donations that are not reported in Form 10BD as anonymous donations.

Dear Team,

What should be Section under which donation is eligible for deduction in case of donation received as a part of CSR Activity?

The company will not be eligible to claim the CSR expenses as donations u/s 80G. But Trust will have to show it as a specific grant under donation type for CSR funds received by them.

But today(16.05.2022) in the CBDT webinar it was communicated by officials that they would be issuing a clarification in this regard. so should wait for a day or two

trust received donation from company under CSR activity is this required to report under form 10BD.

ALL THE DONATION RECEIVED BY TRUST FROM DONOR IS REQUIRED TO FURNISH UNDER 10BE OR ONLY THE DONATION RECEIVED FROM DONOR AND IN RETURN 80G RECEIPT ISSUE TO DONOR ARE REQUIRED TO FURNISH UNDER 10BD

The company will not be eligible to claim the CSR expenses as donations u/s 80G. But Trust will have to show it as a specific grant under donation type for CSR funds received by them.

Trust needs to file details of all the donations received in Form 10BD. The government will treat donations that are not reported in Form 10BD as anonymous donations.

Query

A trust doing medical relief. collects small sums as Rs 100 or 200 from patients as donation. Total amount collected daily is accounted as donation. All are poor patients.They will not claim 80 G. How to include in Form 10 BD these daily donations, or it can be omitted since small amount

It will be treated as an anonymous donation in that case. Clarity on how to report anonymous donations is expected from Government as per the latest webinar held on 16th May 2022.

Are charitable organisation required to file Form 10BD (NIL), even if no donations have been received during the year.

If there are no donations during the FY then you need not file Form 10BD.

Whrether there is legal refenrace for this?

There is no specific legal reference to it.

Form 10BD is a statement of donation. Part B of it cannot be filed nil/blank. If no donations were received by Trust there is nothing to report.

Going forward the same would match with your ITR which will make it clear why Form 10BD was not filed.

No it is not required

Specific Grant received from Government, how to report? We don’t have the Pan number of the Govt Treasury office.

Efforts should be made to get the details of PAN from the Government Treasury Office.

first of all, Thankyou for this article. I have few queries, Please answer

1)We are running a charitable trust. We got provisional approval(Form 10AC). Do we need to file form 10BD?(since we got provisional only, we have this doubt)

2)We have 5-6 anonymous donations got through electronic mode, do we need to enter those details in form 10BD?

Thank you for your appreciation. Glad it was helpful.

1. Form 10BD is required to be filed by every person having approval under section 80G or section 35. It is irrelevant whether the organization has provisional approval or regular approval.

2. Yes every donation received needs to be reported.

how long does it take to get display of DONATION RECEIVED by Trust in 26AS, AIS, & TIS

There is no specific date mentioned by Govt about this. But mostly after 15th June, it should be visible. It is advisable to take form Form 10BE from the Trust as proof.

Hi i recieved donation slip 10BE by the donee but it is not reflecting in 26AS portal.PAN details provided by donee are correct.

Please verify if the details of the donation are reflected in AIS.

Madam, we are an NGO, we have received many donations via our payment gateway like stripe, razorpay, donorbox, etc. These donors have received money receipts from these gateways and the consolidated amounts have been transferred to our account from a centralised account of these gateways.

So, now how do we issue them form 10BE since these donations were not directly credited to our account in their respective names?

If a person has donated on 30th March, 2022 via donorbox, then his amount has been transferred to our account in April along with some other donations, then how can we issue form 10BE for 2021-22 financial year? or should we issue it for 2022-23?

You can ask the payment gateways for details of the donors as they have issued them the receipts. If your donors wish to claim a deduction u/s 80G then it is mandatory for you to file Form 10BD and issue Form 10BE. Otherwise, it is an anonymous donation in the hands of an NGO.

If a person donates on 30th March 2022 it should be considered in FY 21-22 and not FY 22-23.